- Virgin Galactic Stock slumped 10% this week on the news that founder Richard Branson sold another $300 million of stock.

Virgin Galactic Stock slumped 10% this week on the news that founder Richard Branson sold another $300 million of stock.

Virgin Galactic Holdings (NYSE: SPCE) hit a 7-month low of $14.44 on Thursday as sellers rushed to exit the ill-performing space tourism company. Branson’s latest transaction brings his total sales to more than $1 billion, reducing his holding to 11.6%. A representative for Virgin Group said the deal would help support Branson’s other business interests, including Virgin Atlantic Airways. However, the market appears less-than-impressed with the insider sale.

Notably, when Chairman Chamath Palihapitiya sold $213m of stock in March 2020, the stock sold off more than 40% in the six weeks that followed. And considering the current headwinds facing equities, the price may react similarly now.

SPCE Price Forecast

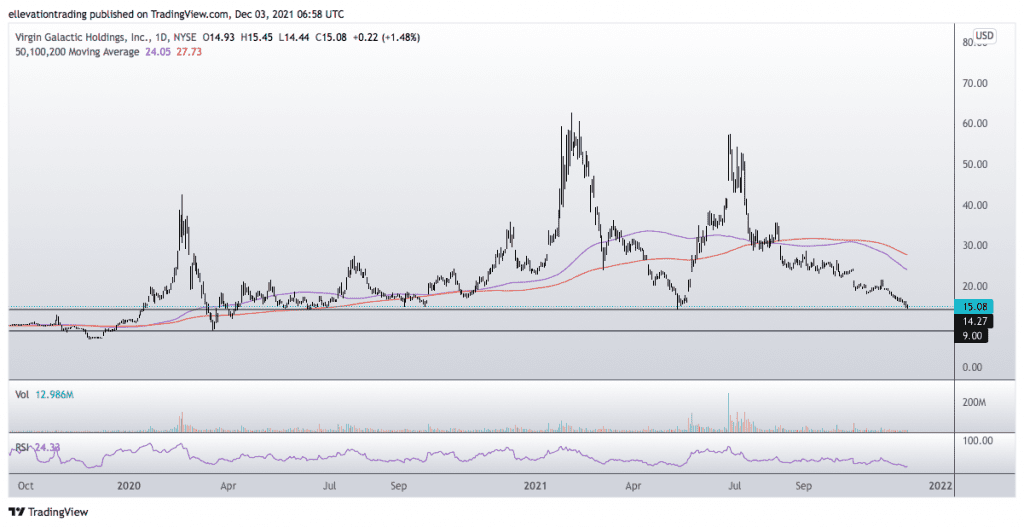

The daily chart shows SPCE is sitting on long-term horizontal support at $14.27 (2021 low). If the stock trades below $14.27, I expect the price to extend towards the March 2020 pandemic low of around $9.00.

Whilst the above statement is incredibly bearish, it’s hard to find a compelling counter-argument in the current environment. Huge insider selling ahead of an accelerated taper from the fed paints a bleak picture for Virgin Galactic. Furthermore, the technical backdrop is extremely poor and will remain so as long as the price is below the November 10th high of $21.68.

On that basis, I believe the $9.00 price target is easily achievable. However, as mentioned, a close above $21.68 improves the outlook and therefore invalidates the bearish view.

Virgin Galactic Stock Chart (Daily)

For more market insights, follow Elliott on Twitter. Virgin galactic stock