- Vikram Solar shares debut at a premium on NSE and BSE after a heavily subscribed IPO. Here’s the listing price, GMP details, and outlook.

Vikram Solar (NSE: VIKRAMSOLR) debuted yesterday. The stock listed at ₹340 on the BSE, a 2.4% premium to the ₹332 issue price, and at ₹338 on the NSE (+1.81%). In Wednesday’s follow-through trade, shares were changing hands near ₹357.50, roughly 8% above the issue price, putting the company’s market capitalization a little over ₹13,000 crore.

How Did Investors Respond to the IPO?

The ₹2,000 crore IPO drew overwhelming demand, underscoring investor confidence in India’s renewable energy push. Subscription data shows:

- QIBs (Qualified Institutional Buyers): 142.79x

- NIIs (Non-Institutional Investors): 50.9x

- Retail Investors: 7.65x

Expectations that Vikram Solar will profit from the government’s ambitious renewable capacity targets and business demand for solar solutions are reflected in this high appetite.

What Was the Grey Market Premium (GMP) Ahead of Listing?

The last reported GMP stood around ₹37, suggesting a listing near ₹369 per share. While the actual debut was slightly softer, the positive momentum in opening trades indicates investors were willing to hold positions beyond the grey market signals.

What Is the Growth Outlook for Vikram Solar?

Analysts highlight both opportunities and challenges. On one hand, Vikram Solar is expanding capacity through a new Tamil Nadu facility, which is expected to be operational by FY27. Policy levers like PM Surya Ghar Muft Bijli Yojana and the PM Kusum scheme provide structural tailwinds for domestic demand.

On the other hand, Vikram Solar currently runs on thinner margins than some peers, given its limited export footprint and lack of backward integration. Broader profitability is expected to improve as its solar cell unit ramps up production and as India accelerates its transition toward utility-scale and captive solar projects.

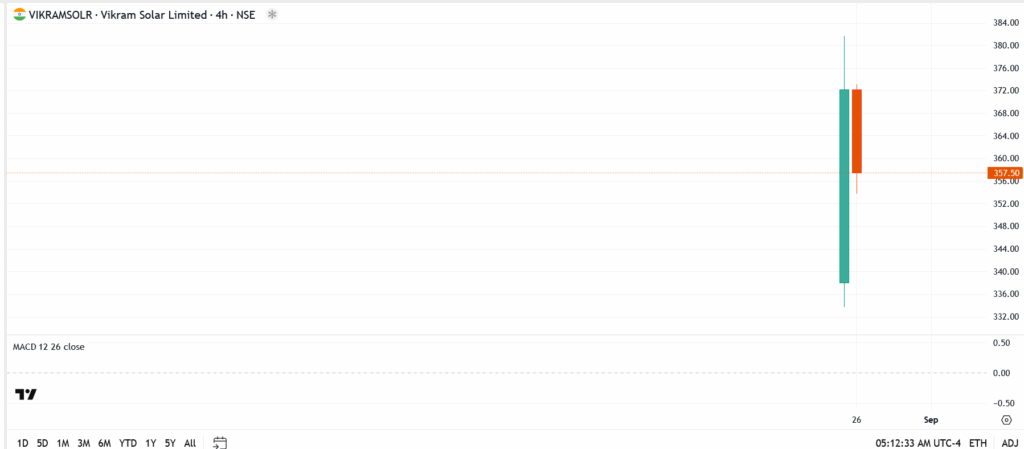

Vikram Solar Share Price Chart Analysis

- Current price: ₹357.50

- Immediate support: ₹350

- Next support: ₹338

- Resistance levels: ₹372, then ₹384

Momentum indicators suggest early buyers are protecting the ₹350 zone, but a breakout above ₹372 could set the stage for a test of ₹400 in the coming sessions.

Conclusion: Is Vikram Solar Stock Worth Holding After Listing?

Vikram Solar’s debut has been constructive rather than explosive, a premium open backed by strong subscription demand, but without the wild surges that often fade quickly. The fundamentals lean on India’s solar growth story, government-backed schemes, and upcoming capacity expansion. Still, margins and execution risks mean investors will be watching quarterly updates closely. For now, ₹350–₹372 is the band to watch, as it will decide whether the stock consolidates or builds a fresh leg higher.

Shares listed at a 2.4% premium on BSE and 1.81% on NSE, with intraday highs extending gains to nearly 8%.

Capacity expansion, government renewable energy schemes, and rising demand for utility-scale solar projects are expected to be the key drivers.