- Markets are bouncing back as US government shutdown fears ease. In this ecosystem, AstraZeneca, Apple and Goldman Sachs are primed to rise.

Yesterday’s news cycle, which saw a strong rally across many sectors, provides the foundation for today’s market outlook, suggesting momentum remains. The main thing boosting the market sentiment is the optimism around the U.S. government shutdown possibly ending soon, which is making investors more confident. From pharma breakthroughs to Wall Street wins and tech resilience, AstraZeneca, Apple and Goldman Sachs stocks blend stability with spark.

AstraZeneca Share Price

AstraZeneca (NASDAQ: AZN) has been on a tear, and frankly, it’s not surprising. The pharmaceutical giant is looking less like a slow-moving utility and more like a growth stock, primarily powered by its Oncology division, which accounted for a huge chunk of its most recent quarterly revenue. Q3 revenues blasted past $15 billion on soaring cancer drug sales, as CEO Pascal Soriot spilled on Yahoo Finance’s Market Sunrise

The real headline grabber, however, is the pipeline. Just recently, their stock jumped because a hypertension drug, baxdrostat, had great results in late-stage trials. The market loves a drug that could be a huge hit, and this news is really boosting the stock.

Furthermore, their recent quarterly results were genuinely impressive and management is also sticking to their ambitious targets, aiming for $80 billion in annual sales by 2030.

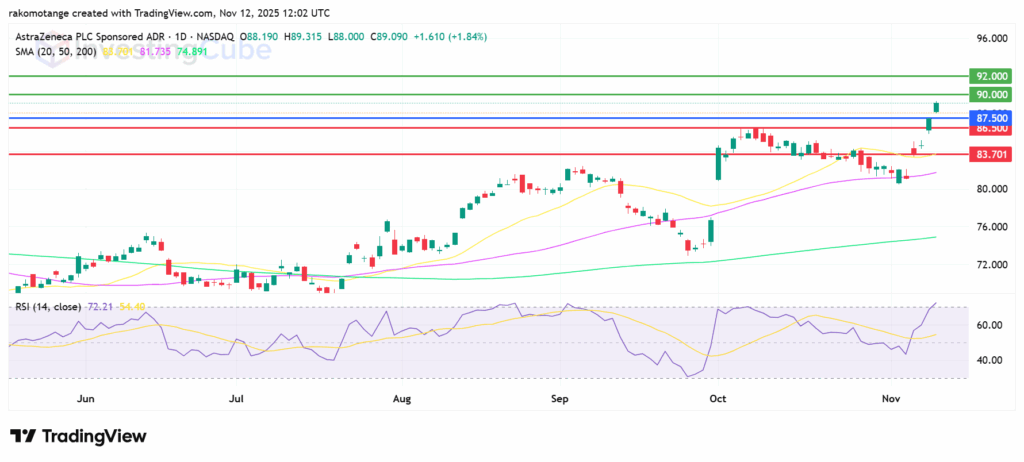

AstraZeneca Stock Technical Analysis

AZN has a good technical rating overall, which means it’s likely to keep going up in the long run. The stock hasn’t moved too much recently, but now it seems to be heading up. There’s support around $80.80 – $83.35, with moving averages backing it up.

If it goes above its resistance at $85.31, it might really take off towards its 52-week high of $86.57. The 20-day, 50-day, and 200-day Simple Moving Averages (SMAs) are all going up, and the price is above them, which confirms that the stock is looking strong.

AstraZeneca stock daily price chart on November 12, 2025. Source: TradingView

Apple Inc. Share price

Even though the tech sector has been shaky lately, Apple (NASDAQ: AAPL) did well yesterday, rising by 2.16%. The stock is benefiting from a general market rotation back into mega-cap quality names following a brief, exaggerated sell-off in AI-linked stocks.

Furthermore, a significant share of its recent rally has been tied to positive reports regarding the early success of its iPhone 17 sales and continued strength in its high-margin services division. This perception of stability and solid execution sets it apart from other fast-growing companies that are dealing with valuation worries, making it a good option as the market shifts.

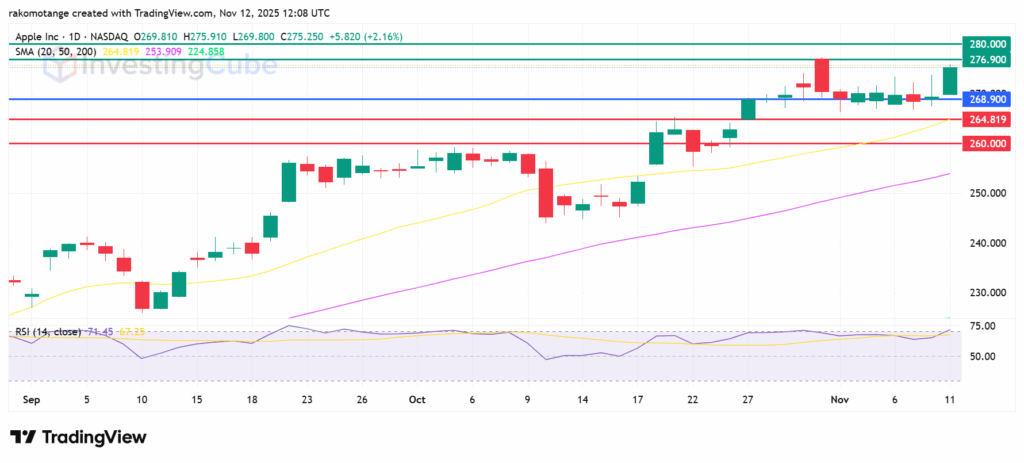

Apple Stock Technical Analysis

AAPL’s 20-day SMA at $264 is a key level of support, with $260 as a backup. Also, However, the RSI at 71 is overbought, and that could send the price lower to test $260. The price is above that level at $275, which signals bullish control. There’s likely to be initial resistance at $276.90, with the second one likely at $280.

Apple stock daily price chart on November 12, 2025. Source: TradingView

The Goldman Sachs Group Share price

Goldman Sachs (NYSE: GS) is among the Dow’s single most influential component due to its high share price. Financial companies are getting a direct boost from the improved sense of political stability because the government shutdown might be nearing an end. A functioning government removes a layer of systematic risk and regulatory uncertainty, which is financial rocket fuel.

Furthermore, if the economic environment is perceived as more stable, it leads to increased optimism around capital markets activity. Mergers, acquisitions, and initial public offerings are all areas where Goldman Sachs excels. This cyclical confidence and reduction of systemic risk provide a strong, immediate catalyst for a high-weighted gain.

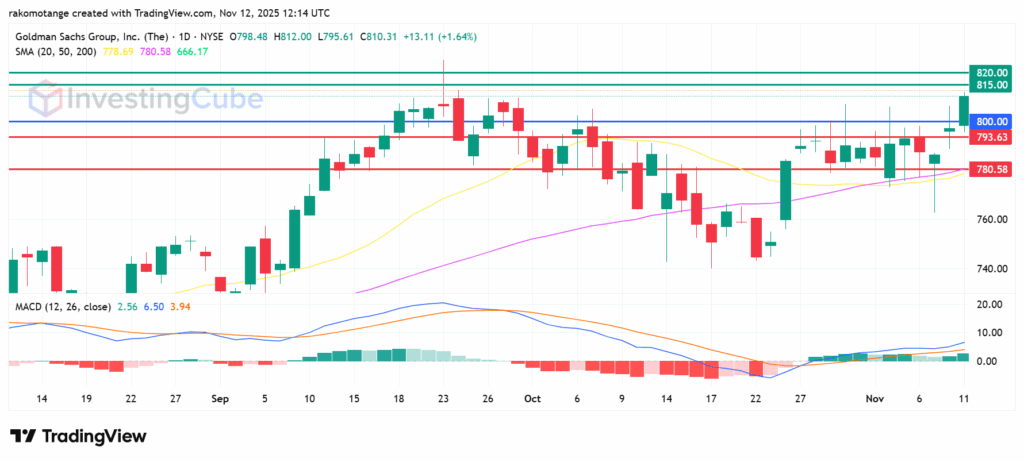

Goldman Sachs Stock Chart

GS is trading above the psychological $800 pivot acting as immediate support. Initial support is at $793.63, while the second support is likely to be at the 50-day SMA at $780.58. MACD at 6.50 points to bullish control, which will likely meet the first resistance at $815. A break above that level will likely meet the next barrier at $820.

Goldman Sachs stock daily price chart on November 12, 2025. Source: TradingView

In Summary

The common thread underpinning the projected gains for these heavyweights is the immediate psychological relief stemming from the de-escalation of political and fiscal uncertainty in Washington.

AstraZeneca stock price outlook is boosted by thr positive news surrounding its Oncology division’s strong revenue growth and the successful trials of its hypertension drug, baxdrostat, which have boosted investor confidence.

GS outlook is supported by the calming of tension around US government funding and improving global economic outlook, which favour growth in investments and financial services.

Apple’s price is upbeat due to strong iPhone sales guidance and growth in its high-margin Services segment. Furthermore, analyst upgrades and the anticipation of new ventures like robotics are fueling investor interest.