- Amazon, Amgen and BP stocks are likely to ride on positive sentiment around their fundamentals, with AMZ and AMGN earnings weighing in too.

Amazon, Amgen, and BP are all likely to be among the top gainers today because of specific, positive developments. These blue-chip stocks are riding high because they combine innovation with value. This is based on a mix of company-specific fundamentals and general industry sentiment, as explained below.

Amazon Share Price

Amazon stock (NASDAQ: AMZN) is doing well after the company reported forecast-beating Q3 2025 earnings last week. This was due to rising expenditure on AI infrastructure and AWS cloud domination. The company had a YoY revenue growth of 12% to 180.2 billion versus the forecast $177.8 billion. Its EPS came at $1.95, beating analysts’ consensus estimate of $1.57.

Meanwhile, Amazon Web Services had a massive 20.2% YoY growth, earning the company On October 31, the shares of the e-commerce giant hit a record high, which boosted sentiment at the Nasdaq and the Dow.

Analysts say that strong pre-market trading is a sign of ongoing consumer spending and AI-driven revenue growth as important factors. Also, Amazon’s wide range of businesses, from retail to advertising, puts it in a good position to leverage the holiday season.

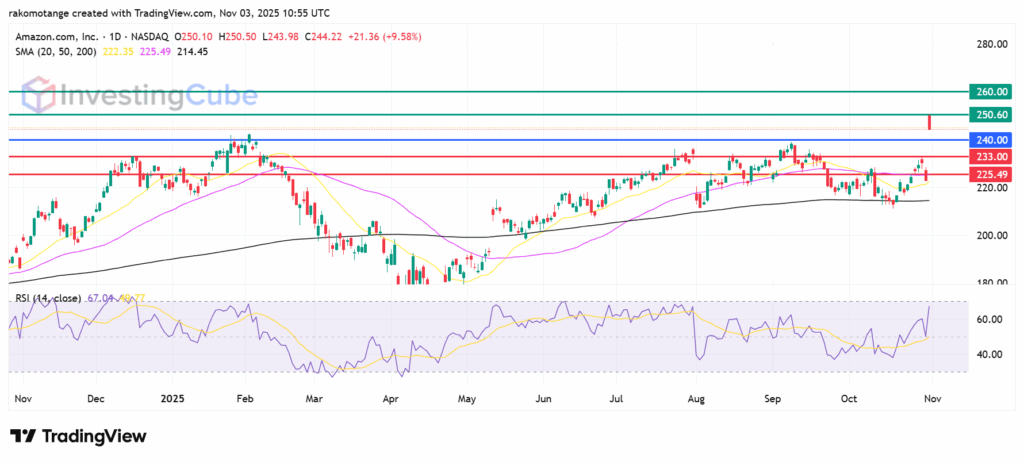

Amazon Technical Analysis

Amazon stock trades at $245 pre-market, up from $244.22 Friday close, fueled by earnings momentum. Shares hover bullishly above 50-day SMA of $225.49 and 200-day SMA of $214.45, signaling buy. Key support will likely be at $240 pivot, but the downside could eye $233 if the momentum strengthens. Primary resistance is likely to come at $250, beyond which a stronger momentum could test $260 high. RSI at 67.04 suggests buy strength that is nearing overbought.

Amazon stock daily chart with key Simple Moving Average Levels. Source: TradingView

Amgen Inc. (AMGN) Share Price

Biotech leader Amgen (NASDAQ: AMGN) is gaining ground on positive news about its pipeline of obesity treatments, competing with other companies in the sector as healthcare mergers and acquisitions rule the news. Pre-market quotes show a 1.2% rise, which is backed up by a shift in the market toward safer stocks as inflation slows down. Tomorrow, on November 4th, Amgen is expected to release its Q3 2025 earnings report.

The sentiment around the earnings is currently the most important driver of Amgen stock price. Amgen stock’s recent results also look good. With a good +2.20% gain by the end of trading on Friday, October 31st, Amgen was actually one of the top three gainers on the Dow Jones Industrial Average.

This momentum is probably due to the company’s recent announcement of a $2.38 per share quarterly dividend.

Also, there’s good news from regulators, notably the EU’s clearance of its medicine Tezspire, which was reported by multiple biotech news outlets. Also, time is everything, and Amgen got it right when they announced a new Q4 dividend raise on October 31 through PR Newswire. The payout went up from $2.25 to $2.38 per share, which will be paid on December 12 to shareholders of record on November 21.

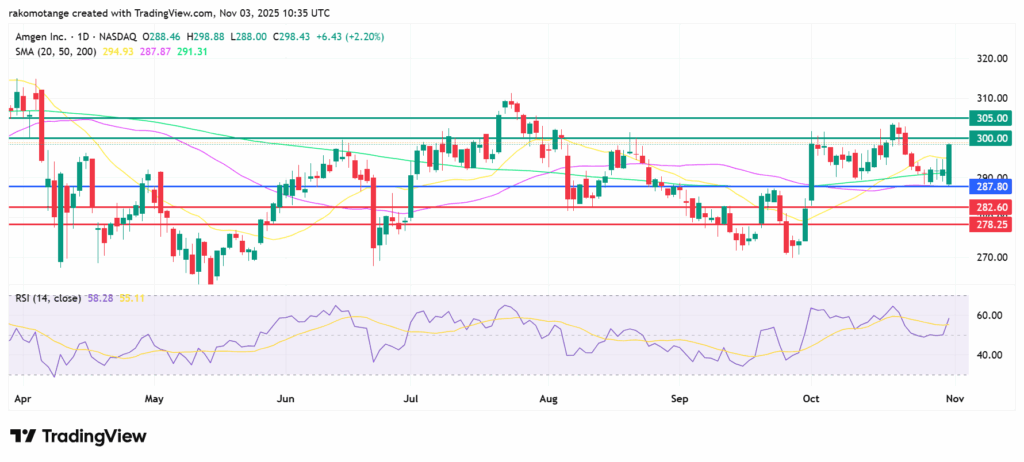

Amgen Stock Chart

From a technical point of view, Amgen stock is currently showing a pattern of consolidation within a set range. The stock is mostly trading above its 50-day and 200-day Simple Moving Averages (SMAs), which is a generally optimistic sign that the medium- and long-term trends are still good. Immediate resistance zone will likely be around $300 to $304.

If the price breaks above this area and stays there, it might start a big upward technical breakout. On the other hand, immediate support will likely be found around the $287 to $282 range, where the shorter-term SMAs lie. If this support level breaks down, it could mean that the price is going back up to the stronger long-term support level at about $278.25.

Amgen stock daily chart with key Simple Moving Average Levels. Source: TradingView

BP Share Price

In the near-term, BP’s stock seems like it will be strong as long as oil maintains above important support levels and the mood in the energy markets stays positive. But how well the company does in the medium term will probably depend on how well management can sell its assets, pay off its debts, and navigate the ongoing green energy transition.

Overall, BP’s present rise is due to solid oil fundamentals. Specifically, OPEC+’s decision to pause output increases for early 2026, could help ease concerns over supply glut and add support to BP stock price’s near-term upside momentum.

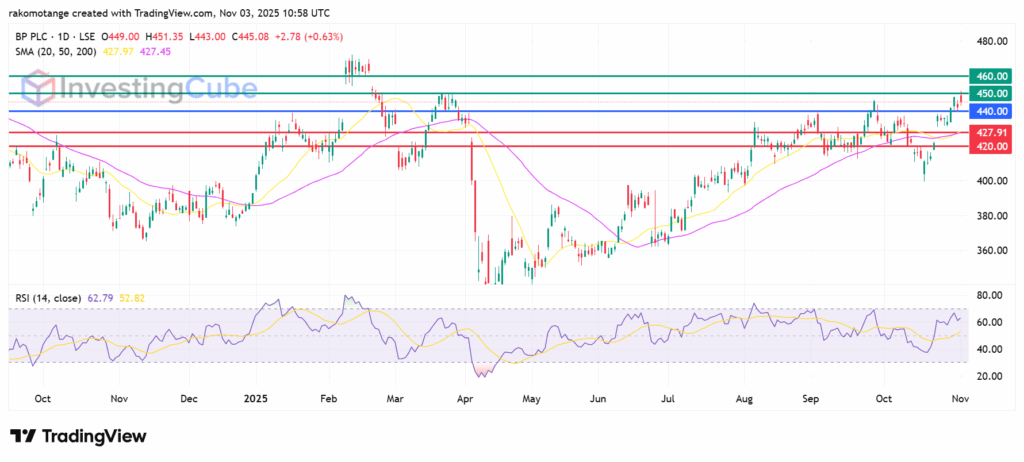

BP Stock Price Today’s Analysis

BP stock daily chart shows a positive picture, with shares at +0.63%, according to TradingView data. The 50-day SMA at 427.45p is a key support level, and buyers defended last month’s dip around that level.

The 20-day SMA at 427p will likely be the near-term floor. The first resistance level is likely to be 450p, which is the most recent swing high from the rally in October. If the price breaks through this level, it could go for 460p. RSI at 62 means there is room to run without getting too hot.

BP stock daily chart with key Simple Moving Average Levels. Source: TradingView

Currently, the highly anticipated Q3 2025 earnings report, a key catalyst for volatility of Amgen stock price.

The main risks facing BP stock include potential decline of oil prices, slower global demand for oil, and challenges balancing fossil fuels with renewable investments.

Amazon stock has a strong positive sentiment around it following strong earnings report released last week, which showed AWS cloud segment on a strong growth path.