- Boeing is upbeat as the Pentagon and Polish government make new orders.

- Broadcom's outlook has improved on the back of success of its products in Gemini 3 rollout.

- Barclays is buoyed by reduced geopolitical risk in Europe and extension of share buyback program which has signaled confidence in its future growth.

It’s worth considering the stocks that might brighten your portfolio today. Boeing (BA), Broadcom (AVGO), and Barclays (BCS) are all in the news for new reasons, and their technical setups suggest that they will go up. These names combine good news with charts that show possible rallies or continuations, even though the markets are still volatile. Let’s explore why they could rank among the top gainers, drawing on recent headlines and data.

Boeing

Boeing (NYSE: BA) looks like it might go up, mostly because it recently won big defense contracts. The company has had some problems, but it just got a big boost. The Pentagon announced contracts worth more than $7 billion for military projects. This could help stabilize earnings during tough times.

According to Reuters, this award underscores Boeing’s enduring role in defense, potentially easing investor concerns after a 9.2% November dip reported by StockTwits.

Meanwhile, news reports, including an announcement confirmed by the company itself, highlighted a substantial Foreign Military Sales contract, valued at nearly $4.7 billion, to produce 96 AH-64E Apache attack helicopters for the Polish Armed Forces

Boeing Stock Chart

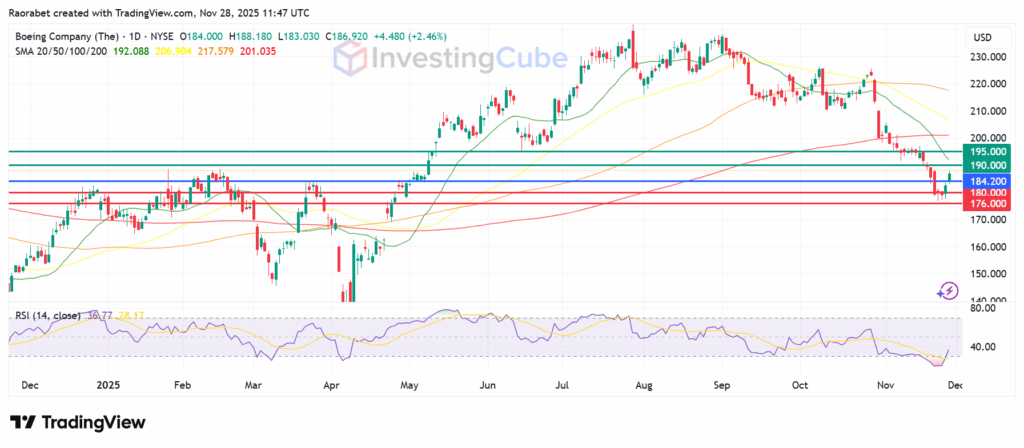

Boeing stock chart reveals primary support at $180. Action below that level could send the action lower to the second support level at $176,near the recent 30-day low, offering a floor for any pullback. The pivot is at $184.20, with the first resistance likely at $19. Above that level, Boeing stock could go higher to test $195. The RSI at 36.77 is near oversold conditions, priming for a bounce as buying pressure builds.

Boeing Stock Price daily chart on November 28, 2025 with support and resistance levels. Created on: TradingView

Broadcom

Broadcom (NASDAQ: AVGO), the leader in semiconductors, is riding the AI wave with strong tailwinds. Goldman Sachs recently raised its price target ahead of December reporting, citing strong demand, as CNBC reported.

Recent excitement is also tied directly to the success of its major client, Alphabet’s Google, particularly following the launch of their latest AI model, Gemini 3. The positive reception of Gemini 3 is widely expected to boost demand for Tensor Processing Units (TPUs) and Broadcom’s broader AI offerings.

Analysts at Jefferies have even labeled Broadcom as one of the best semiconductor stocks to buy, saying that demand for TPUs could rise, which is a good sign for the company.

Broadcom Stock Prediction

Broadcom stock price last closed above the pivot mark at $390.60 and the upside will likely meet the first hurdle at the psychological $400. The RSI is at 66.88, which means there’s good momentum without the stock being overbought. A stronger buying momentum could clear that barrier and go on to hit record highs of $405. On the downside, AVGO price has the first support at $385.40. A break below that level will invalidate the upside narrative and could send it lower to the second support around $377.60.

Broadcom Stock Price daily chart on November 28, 2025 with support and resistance levels. Created on: TradingView

Barclays

Barclays (LSE: BARC) is a solid European stock. The bank completed a £1 billion share buyback and started a new £500 million program. These moves usually raise the stock price because they reduce the number of shares available. Barclays also went above its 200-day moving average, which adds support to the idea that the stock will go up. Also, European stock markets are doing better overall, possibly because geopolitical risk is lower, according to Barclays.

Furthermore, broader relief across European equity markets, potentially stemming from reduced geopolitical risk as cited in a recent Barclays note, could provide a favorable backdrop for the banking sector today. These factors make it a quiet contender for gains.

Barclays Share Price Forecast

Barclays share price has its pivot at 425p and trading above that level favours the buyers to be in control. The stock will likely meet the first resistance at 433p, but an RSI of 65.72 points to a strong momentum that could result in an extended bullish momentum that could see it test 440p. On the downside, the first support is at 411.82p, below which the upside narrative will be invalid and the resulting momentum could pave way to test 405.70p.

Barclays Stock Price daily chart on November 28, 2025 with support and resistance levels. Created on: TradingView

Boeing is supported by a strong order book. The most recent one is a $4.7 billion Foreign Military Sales contract for AH-64E Apache helicopters to Poland. The Pentagon also revealed a $7 billion contract for Boeing this week. These defense contracts provide a strong, high-visibility revenue stream, helping to offset commercial production delays.

Broadcom is a key partner in the AI ecosystem, helping to produce custom-designed Tensor Processing Units (TPUs) for clients like Google. The positive reception of Google’s Gemini 3 AI model will likely significantly boost demand for these high-margin AI chips.

Market narratives and analyses suggest Barclays is trading at a meaningful discount to its estimated intrinsic value. This undervaluation, coupled with strategic investments in digital platforms, supports potential for long-term revenue and margin growth.