- Tesla shares up 6% after Elon Musk bought $1 billion worth of stock, boosting confidence ahead of a proposed $1 trillion CEO pay package.

Tesla shares jumped more than 6% in premarket trading Monday after CEO Elon Musk disclosed the purchase of nearly $1 billion worth of stock, a move seen as a direct response to the board’s proposed $1 trillion compensation plan.

According to a regulatory filing released today, Musk bought about 2.57 million Tesla shares on September 12 at prices ranging from $372 to $396, using his revocable trust. The purchases lift his stake in the electric vehicle giant by roughly 0.6%, reinforcing his personal bet on the company’s long-term trajectory just as its board pushes to secure his leadership for another decade.

The timing of the purchases coincided with Tesla Chair Robyn Denholm highlighting the proposed pay package in an interview, describing it as critical to ensuring Musk remains fully focused on Tesla’s next growth chapter.

Musk Eyes Greater Control Over Tesla’s Future

Musk has previously said he would be reluctant to scale Tesla’s artificial intelligence efforts unless his ownership rises to around 25%, compared with about 13% currently.

The new pay plan, which will go to a shareholder vote in November, would grant Musk enough performance-linked options to raise his voting control to between 25% and 29%, but only if Tesla hits a set of ambitious milestones, including lifting its market value beyond $8 trillion and selling one million robots over the next decade.

If approved, the package would be the largest CEO compensation plan in corporate history and could reshape Tesla’s ownership structure.

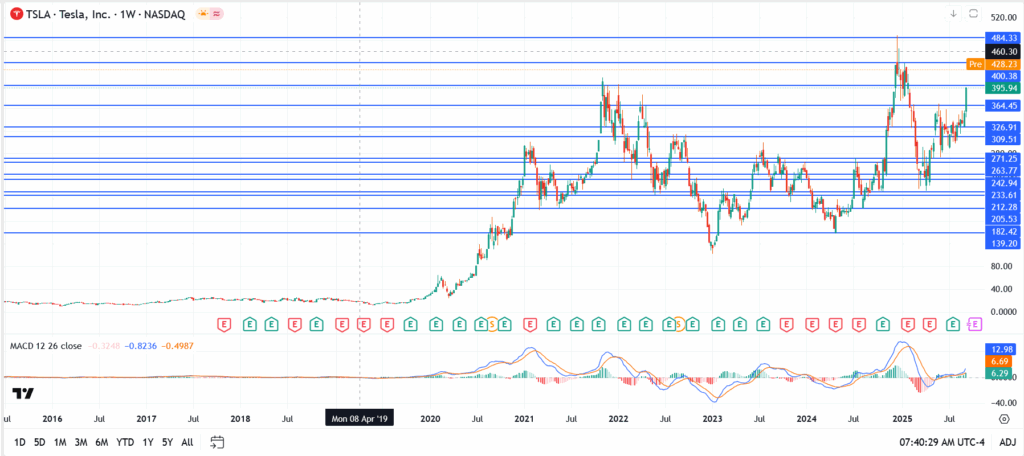

- Current price: $428.23

- Support: $400, $364, and $326 if profit-taking sets in.

- Resistance: $460, followed by $484 on a breakout.

Trade entry: Short-term traders may eye pullbacks into the $400-$405 zone as a potential entry if support holds. A break below $400 could tilt risk toward $364.

Tesla Stock Outlook

Musk’s bold share purchase has reignited market enthusiasm just as Tesla’s board seeks to secure his leadership with a historic pay plan. While the stock remains volatile, the combination of insider conviction, ambitious growth targets, and building AI momentum has shifted sentiment firmly back to the bullish side.

If Tesla can hold above $400 and build on today’s premarket gains, the stock could attempt a move toward the $460-$484 range in the coming sessions.

Tesla FAQs: Key Questions After Musk’s $1 Billion Share Purchase

Investors want to know what motivated the timing, whether it’s about boosting confidence, countering dilution, or aligning with the proposed pay package.

The $1 trillion conditional pay package is in the headlines. Many are asking whether the $1B buy links to boosting his control or meeting ownership thresholds tied to performance targets.

People want to know how the stock price has moved, such as the 7-8% premarket jump, and whether today’s surge is part of a longer trend.