Tesla shares closed Monday at $293.94, down over 6% in a single session, wiping more than $15 billion off Elon Musk’s net worth. The slide marks the stock’s lowest close in nearly a month and comes as traders digest Musk’s latest curveball: a declaration that he’s forming a new political party, triggering backlash from both ends of the spectrum.

In premarket trade today, TSLA is hovering just under $294, with sentiment fragile and momentum clearly tilted to the downside.

Musk’s ‘New Party’ Sparks Political Firestorm, and a Selloff

Elon Musk revealed plans to launch a third political party over the weekend, positioning it as a “rational centrist” alternative. But the announcement has landed poorly with investors. Critics see it as another distraction from Tesla’s core business, while political watchers say it could split conservative votes in the U.S., something Trump loyalists have already slammed.

The backlash was swift. Multiple headlines tying Musk’s comments to Tesla’s stock slump dominated Monday’s news cycle, adding to pressure that was already building after last week’s weaker-than-expected deliveries.

Tesla Share Price Technical Breakdown

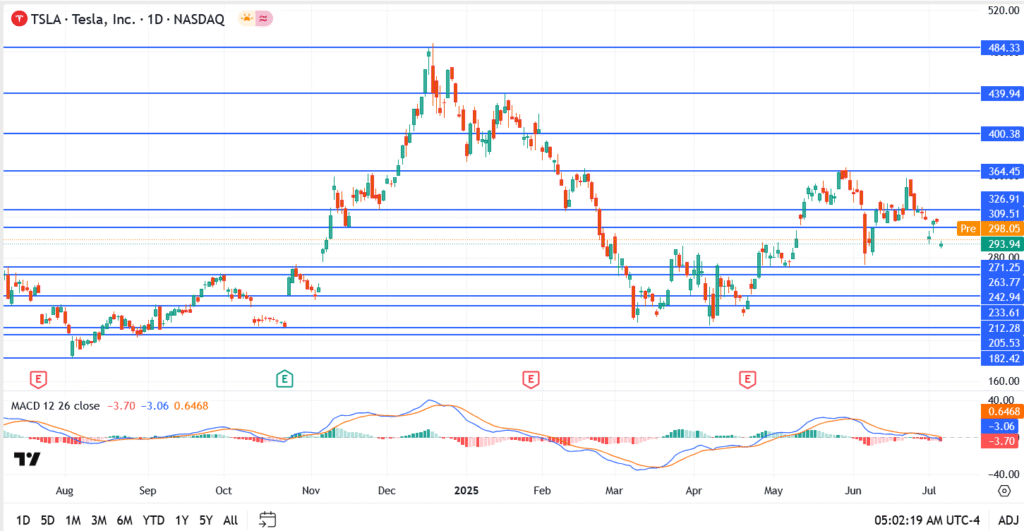

- Previous Close: $293.94

- Premarket: Soft, trading just below $294

- Resistance: $298.05, then $309.51

- Support Levels: $293.00, then $280.00 and $271.25

Outlook

Musk’s political stunt couldn’t have come at a worse time. With delivery growth already under scrutiny and competition heating up in EV markets, Tesla bulls needed focus , not fresh controversy.

Unless Tesla can reclaim $298 quickly, the risk of sliding toward $280 remains high. For now, the market is treating Musk’s latest move as a distraction, not innovation, and price action is reflecting that reality.