- Despite recent share price underperformance, Tesco continues to be the market leader in the retail segment, with 28% share

- Its Clubcard program gives it an unparalleled consumer data mine that give it an edge

- Rising competition in terms of pricing wars could hurt margins

Tesco share price is down about 2.07% in the past month. This drop might look strange during the holidays, but it’s mostly because of worries about a price war. Asda and Morrisons are cutting prices to win back customers, and some experts think this could hurt Tesco’s profits.

Even so, Tesco (LSE: TSCO) is still the biggest player in the market, with a 28.3% share. Some think this drop is a chance to buy low, since holiday spending is expected to jump by 12%. The stock closed at 439.00p on December 22, due to a few things happening at once. The Guardian mentioned that stores are fighting over prices before Christmas, because people don’t have much money to spend. Because of this, Tesco warned that discounts could lower their profits.

But, this drop might be a good time to buy, as holiday shopping gets busier. Tesco’s strong market share and consistent profit growth show they can handle tough times. They’re also buying back £1.45 billion in shares, which is good for investors. It could be said that this drop, during a time when sales usually go up, makes Tesco a good choice for people who are thinking about the future.

Also, Tesco’s scale gives it a significant advantage. With 23 million households participating in the Clubcard program, Tesco’s ability to use data for targeted promotions is unmatched.

Tesco share price prediction

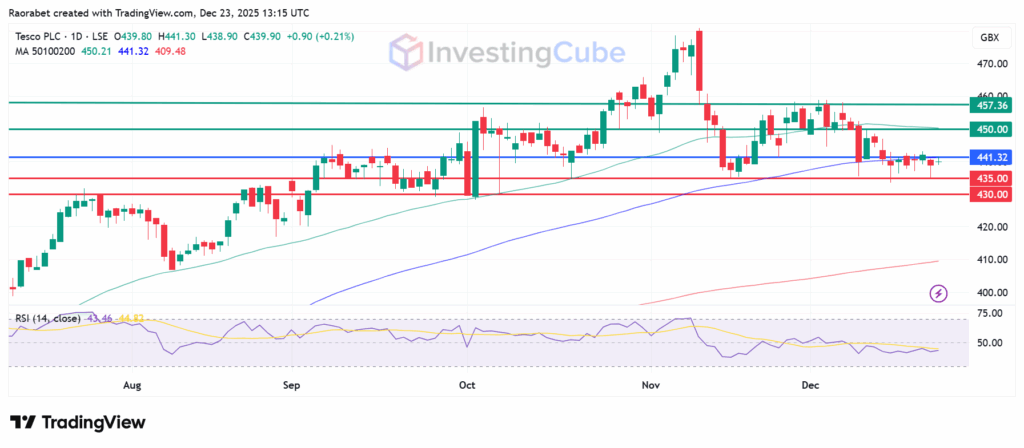

Tesco stock price pivot is around its 100-day moving average of 441.32p. The RSI is down to 43, which indicates that the sellers will likely enjoy near-term control. With that, the first support will likely be at 435p, with the second one at 430p.

On the upside, action above 431.32p could trigger further gains to test 450p, near the 50-day MA. A breach of that barrier could result in further gains to test 457.36p.

Tesco stock daily chart with near-term support and resistance levels created on TradingView

The decline is primarily driven by fears of a “price war” initiated by Asda. Investors are concerned that Tesco may have to sacrifice profit margins to maintain its 28% market share against aggressive discount campaigns.

Technically, yes. With the RSI at 43 and the stock on the brink of retesting the 100-day moving average support, it potentially offers a safer entry before the January trading updates.

With more than 23 million holders, the Tesco Clubcard is an asset not only to incentivise buyers to stay loyal to Tesco, but it also offers valuable data that helps the company to strategise.