- Tata Steel share price has registered four successive losses, but a look at its fundamentals should calm anyone's nerves.

The downward pressure on Tata Steel share price extended on Wednesday, closing the session at ₹159.00 after declining by 1.83%. The downturn is attributed to investors’ move to lock in profits following a strong rally in recent months. The stock had gained approximately 24% over the last quarter. Therefore, the recent move appears to reflect a natural pause in momentum, rather than a fundamental shift in the company’s outlook.

Generally, the pullback on Tata Steel share price appears to be a short-term breather after a robust rally. Key factors at play include relative underperformance, profit-taking, and technical weakness. However, underlying fundamentals—strong domestic demand, stable production, and favorable valuations—continue to support the mid-to-long‑term case.

From a sectoral standpoint, concerns around potential Chinese steel oversupply continue to cast a shadow over global steel prices. However, Indian steelmakers like Tata Steel remain relatively insulated due to strong domestic demand, policy support from infrastructure spending, and growing focus on sustainable steel production. These favour continued uptrend by Tata Steel share price. Meanwhile, recent production updates from the company show stable operations in India, with Q1 output holding steady year-on-year at 5.26 million tonnes, despite maintenance shutdowns.

Fundamentally, Tata Steel (NSE: TATASTEEL) continues to maintain a solid position. The company offers a reasonable dividend yield of around 2.2%, while long-term prospects remain tied to India’s manufacturing growth, housing demand, and clean energy projects—areas that require significant steel input. While today’s dip may concern short-term traders, the broader fundamentals remain supportive, with most analysts maintaining a ‘Buy’ rating.

Tata Steel Share Price Prediction

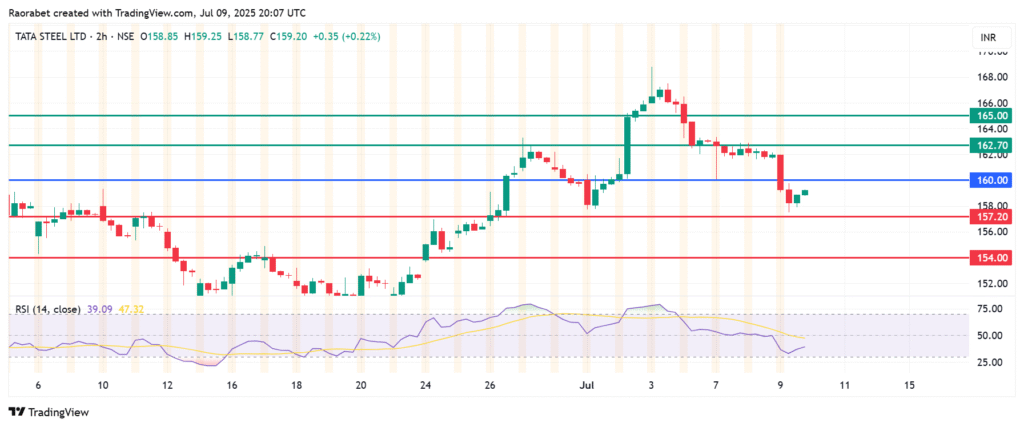

Tata Steel share price pivot mark is at ₹160 and the momentum calls for further downside. The stock will likely find initial support at ₹157.20. Breaking below that level will signal a stronger momentum that could extend losses to test ₹154.

On the upside, going above ₹ 160 will favour the buyers to take control. With that, initial resistance will likely be at ₹162.70. The downside narrative will be invalid below that level. Furthermore, an extended control by the sellers could push the action lower and test ₹165.