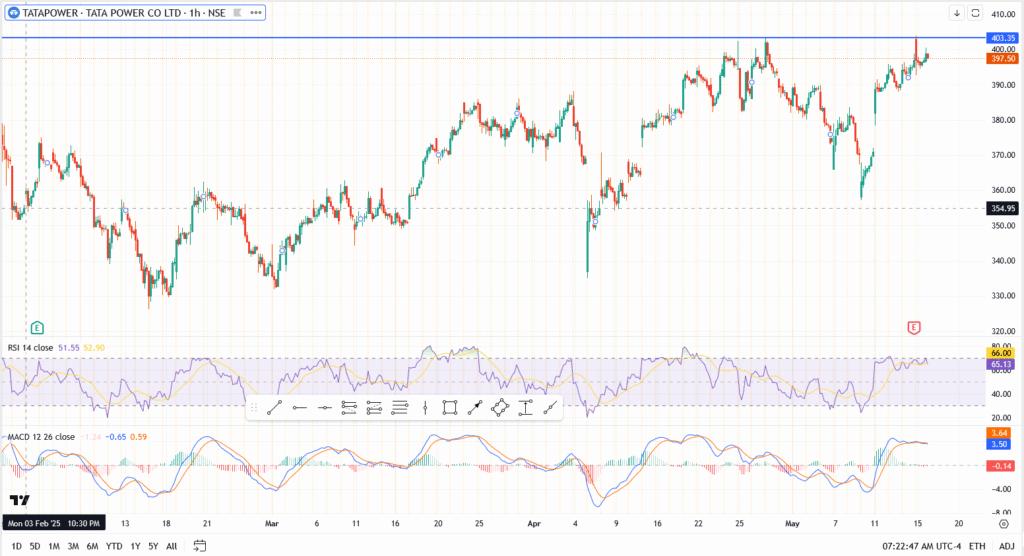

Tata Power share price is trading just under ₹398 on Thursday, inching closer to a critical resistance zone that has capped upside since February. After rebounding nearly 9% from this month’s low near ₹365, the stock is once again testing the ₹403 level a ceiling that has triggered multiple reversals over the past three months. With fresh Q4 earnings now out, the stage is set for a potential breakout or another rejection.

Q4 Earnings Out, Numbers Strong

The results are in. Tata Power posted a 25% jump in profit for the March quarter ₹1,306 crore versus ₹1,046 crore from last year. Revenue was also up, coming in at ₹17,238 crore, a solid 8% rise.

There were no big surprises, but the numbers were definitely solid. Steady performance across generation, distribution, and renewables kept margins healthy. Solar EPC and EV infra also stayed in focus.

So far, the market isn’t overreacting. Price action is muted, but the setup is still bullish if momentum kicks in.

Tata Power Chart Analysis

Since February, the stock has tried and failed to clear ₹403 several times. That level remains the line in the sand.

- Price stuck near ₹397.50

- Major resistance: ₹403

- Above that? ₹420 comes fast

- Support: ₹390, then ₹365

- RSI: 66 — heating up

- MACD: Trending up, but no blast yet

If we get a close above ₹403 on volume, it opens up a clean path toward ₹420+. But another rejection? We’re back in the same chop zone again.

Conclusion

Earnings are out. The stock didn’t explode, but it didn’t fade either, which is usually a bullish sign. Tata Power’s share price is coiling just under the breakout. ₹403 is the battleground. Everything else, including the 25% profit pop, is just noise unless that level gives.