- Suzlon share price is down by more than 34% from its 52-week highs, but its fundamentals send mixed signals. So should you buy or sell?

Suzlon share price has been declining over the last week and for the most part of the recent trading sessions. The price has dropped 4.7% in the last five sessions, and the key metrics suggest that the trend will likely continue in the near future.

Suzlon Energy (NSE: SUZLON) stock has not made any money this year, and it has lost 12% year-to-date and dropped an alarming 34% from its 52-week high of 86.04 recorded in September 2024. The factors responsible for this week’s drop aren’t one-time shocks; they’re reminiscent of past disappointments.

An Inventory of Suzlon Stock Price Decline

Suzlon’s Q1 FY26 results released in August were good, with record deliveries and a growing order book of over 5 GW. However, they didn’t make as much profit after tax due to a large deferred tax bill. This caused a 4.5% drop in Suzlon share price that set the tone for September’s decline. The mixed figures triggered profit-taking, which was made worse by concerns in the broader market about rising interest rates and supply chain problems in the renewable industry.

Tax authorities sent Suzlon a notification about input credits that weren’t eligible under Goods and Services Tax (GST) for the years FY2020-21 to FY2022-23. The company filed a writ petition, and the Madras High Court later threw out the demand. Still, investors are less confident due to the lack of clarity on the amount of tax owed.

The departure of the Group Chief Financial Officer (CFO), who played a crucial role in revamping the company’s financial sheet, added to the concerns. In a growth story as delicate as Suzlon’s, leadership changes can often add a level of uncertainty.

Should You Buy or Sell Suzlon Stock?

Whether or not to buy or sell Suzlon Energy depends largely on how long an investor plans to hold the stock and how much risk they are willing to take. That said, the long-term drivers for Suzlon stock price are still largely the same.

The company benefits from a good regulatory framework, such as the government’s demand for wind turbines to include a certain amount of domestic content. This is good for a well-established local player like Suzlon. Also, Suzlon’s debt-free financial sheet and 22.9% five-year profit CAGR are comforting. However, uncertainties have grown because of risks of growing onshore projects.

With a PE of 35.83, which is below the sector average, the recent dip could be a value trap for long-term holders who are betting on green tailwinds. Investors with a long-term horizon who are bullish on India’s green energy transition and Suzlon’s operational turnaround would want to consider buying the stock in installments. They can also wait for a stability signal or a definite turnaround on the technical charts before investing substantial amounts. Short-term traders can sell when the market is weak, hoping for over 10% decline if support fails.

Technical analysis

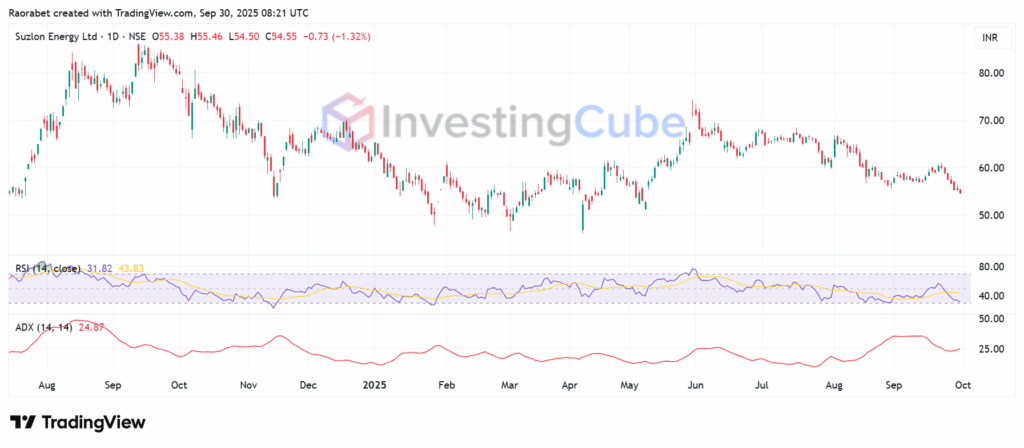

Overall, the technicals say that Suzlon share price is in a consolidative phase, and if the market breaks through critical support zones, it could go down much more. Also, there is no clear “oversold bounce” indicator yet that screams for a bottom reversal, though.

The daily RSI is in the midway zone at 31.82, which means there is a real possibility for it to go down more before it bounces back up. The Average Directional Index (ADX), which is an indicator that measures how strong a trend is, is low at 24.87, which means that there isn’t a particularly strong trend right now.

Suzlon stock price daily chart with RSI and ADX indicator readings. Chart source: TradingView

In Summary

In conclusion, Suzlon’s future depends on policy changes and order execution. In this situation, being patient may pay out more than being hasty. The technical analysis screams caution and says not to buy prematurely. However, the fundamentals tell of a de-leveraged company in a high-growth, which is still interesting for people who want a long-term investment. Investors need to be mindful about the short-term technical risk versus the potential long-term fundamental returns.

The recent drop is mainly due to weak net profit (caused by a tax charge), the CFO’s exit, and general profit-booking following a major rally.

Technical analysis shows Suzlon is neutral with weak momentum, the is RSI mid-zone, indicating cautious consolidation before any clear bullish reversal emerges.

The current decline is a potential long-term buying opportunity. The company’s fundamentals signal a “Buy,” opportunity, backed by a record order book and government push for green energy.