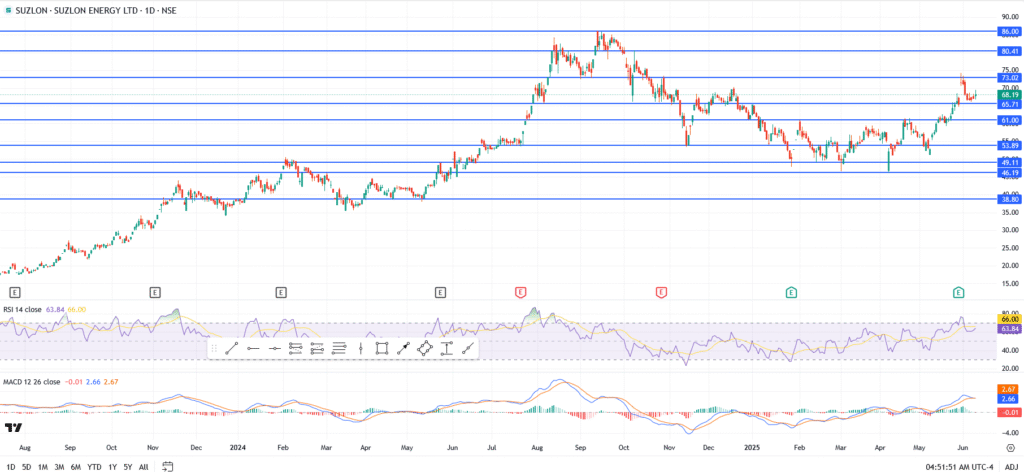

After completing a ₹1,462 crore block deal on Monday, with high-profile buyers including Goldman Sachs and Motilal Oswal Mutual Fund, Suzlon Energy (NSE: SUZLON) is once again in the news. While volumes surged on the news, Suzlon’s share price cooled slightly from its recent 52-week high, hovering around ₹70 in early Tuesday trades.

The deal, one of the biggest on Dalal Street this month, signals continued institutional interest in the renewable energy firm. Notably, despite short-term volatility, Goldman and HDFC Mutual Fund acquired sizeable positions, demonstrating long-term confidence.

Suzlon Share Price Outlook: Bulls Still in Charge

- Resistance held at ₹73.02, capping Monday’s spike

- Current price stabilising around ₹70.00

- Nearest support sits at ₹68.19 – still holding firm

- Below that, ₹65.71 is the key retest level

Will Suzlon Energy Sustain This Momentum?

With the clean energy push gaining traction in India and global players circling Suzlon’s books, investor optimism is warranted. The block deal validates the stock’s multi-month uptrend, and unless ₹65 cracks, dips may continue to be seen as entry opportunities.

If bulls reclaim ₹73 with conviction, the next upside window opens toward ₹80.41. Beyond that, the long-term swing high of ₹86.00 remains the key level to watch.

For now, Suzlon bulls still have the upper hand.