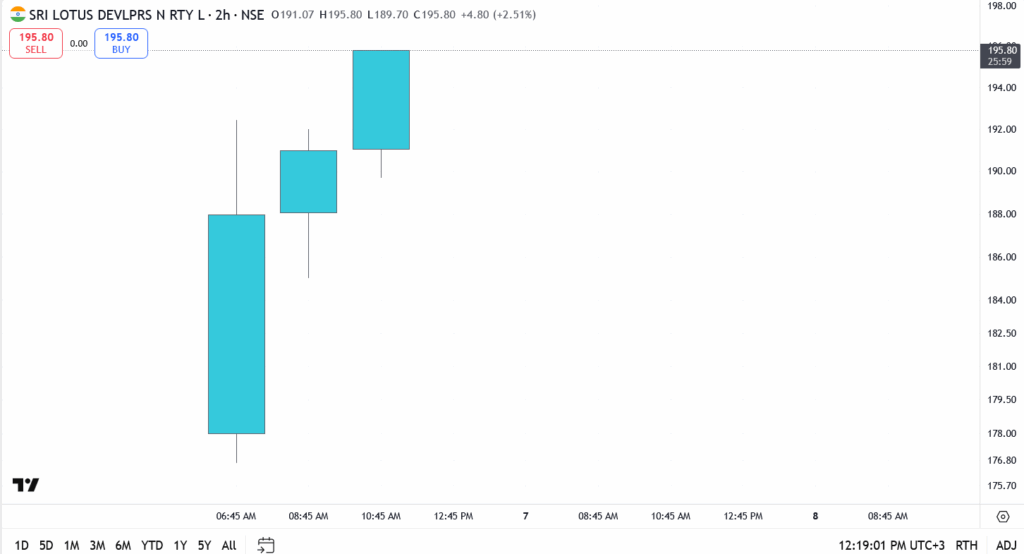

Sri Lotus Developers made a solid entry on the NSE today, listing at ₹195.80, nearly 19% above its issue price of ₹165. The real estate player surprised the Street with stronger-than-expected debut strength, defying mild grey market expectations heading into Wednesday’s session.

There was no institutional muscle behind this IPO, but that didn’t matter. Retail investors and high-net-worth individuals showed up in full force, pushing the issue to nearly 38 times subscribed. It wasn’t flashy, but it had just enough heat to carry momentum into listing day.

Sri Lotus IPO Analysis

- Issue price: ₹165

- Listing price: ₹195.80

- Listing gain: ~19%

- Subscription: 37.95x overall

- Retail interest: Strong, over 30x

Sri Lotus Share Price Outlook

- Current: ₹195.80

- Resistance: ₹198.00, then ₹210

- Support: ₹185.00, followed by ₹175

What’s Driving the Sentiment

Sri Lotus’s regional focus, lean balance sheet, and profitable growth profile have made it a favorite among small-cap IPO traders. The company has a modest but consistent presence in South India’s real estate corridors, and its low-float structure is helping support prices post-listing.

Conclusion

The 19% debut premium is a win for early subscribers, but now the focus shifts to delivery volumes and whether the stock can hold above support in the coming sessions. For short-term traders, the ₹198–₹210 zone remains a key hurdle. For long-term investors, stability above ₹185 will be the first real test of strength.

Sri Lotus may not be a blockbuster listing, but it’s proving it has enough legs to hold its ground after day one.