Samvardhana Motherson International Ltd (BSE: 517334) announced a 1:2 bonus share issue following its Q4 FY25 earnings report, helping the stock extend its recent rally. On Friday, the stock held firm above ₹150, drawing attention from investors tracking developments in India’s auto components sector.

The company reported a consolidated net profit of ₹654 crore for the March quarter, marking a 2 per cent rise year-on-year. Revenue came in at ₹25,805 crore, up 21 per cent from the same period last year, supported by healthy volumes from Europe and North America. EBITDA for the quarter grew 13 per cent to ₹2,053 crore, with operating margins stable at 8 per cent.

The board also approved a bonus issue in the ratio of 1:2, offering shareholders one additional equity share for every two held. While the record date is yet to be confirmed, the announcement has already improved sentiment, especially among retail participants.

Q4 Results Hold Steady, FY26 Outlook Remains Supportive

Management highlighted steady global demand, better cost efficiencies, and a stronger EV order pipeline going into the next fiscal. The company continues to benefit from its presence across geographies, which helps balance regional supply chain fluctuations.

Brokerages have maintained a positive stance, with price targets ranging between ₹160 and ₹170. Many see the bonus issue as a shareholder-friendly move that could boost liquidity and draw in new investors.

Chart Analysis: Holding Gains Above ₹150, Eyes on ₹160

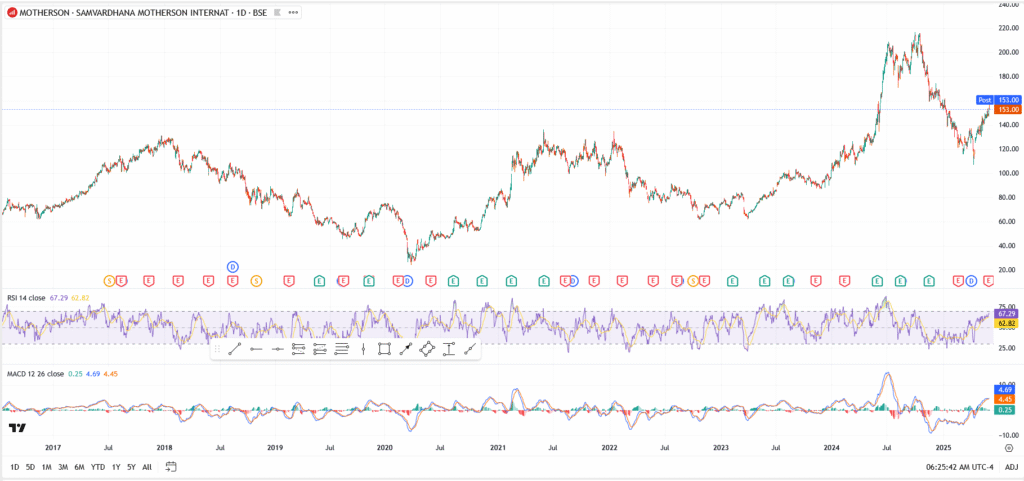

Samvardhana Motherson shares bounced sharply from the ₹125 mark earlier this month and are now consolidating above ₹150. The price has moved steadily, without overextension, and momentum remains on the side of buyers. RSI is hovering around 67, which shows strength but not extreme froth. MACD has flipped into the green and is gradually widening, a sign that trend bias is still building. If the price can push past ₹154–₹155 with volume, the next test could come closer to ₹160. Traders will be watching that level, as it capped the stock back in January. Support now rests at ₹144, and a deeper dip could see interest return near ₹137.

Why the Bonus News Matters Now

The bonus share issue has given investors another reason to look at Motherson more closely, not just as an auto parts supplier, but as a stock with liquidity upside. The Q4 numbers didn’t blow the roof off, but they were consistent. Add that to a solid FY26 roadmap and global diversification, and it’s enough to keep fund managers involved. Retail interest often picks up ahead of bonus record dates, and if that’s the case here, the stock could hold these gains heading into June. It’s not hype, it’s measured optimism backed by decent fundamentals.