- Rolls Royce stock rallied in 2025 primarily due to defence contracts and SMR enthusiasm

- To repeat 2025 heroics, Rolls Royce is looking to UltraFan Engine launch

- Concerns remain over the company's valuation, which could limit the stock's upside

Rolls-Royce Holdings plc stock (LSE: RR.) has seen some ups and downs lately. It jumped over 15% last month, but then took a tumble yesterday and is still dropping today. This makes you wonder what’s going on and if the stock can do as well in 2026 as it did in 2025.

The stock’s rise goes hand-in-hand with good times for the aerospace and defense industries. A big helper was the strong demand in civil aerospace, which makes up almost 70% of the earnings, as reported by the company.

Can Rolls-Royce Repeat 2025 Heroics in 2026?

If it wants to match its 2025 gains this year, the company needs something new to push it forward. The CEO, Tufan Erginbilgic, has already set high goals, aiming for an operating profit of up to £3.2 billion for the full year in 2025 (results coming out February 26, 2026). Now, naturally, investors are now asking if these ambitious targets are already priced in.

This year’s success might look different. It may not be another 90% price jump, 2026 will probably be about getting things running smoothly. The buzz is now around the UltraFan engine launch and how well Small Modular Reactors (SMRs) do in the market.

Potential Risks and Considerations

Risks include execution challenges in programs like small modular reactors and supply chain pressures. Geopolitical shifts or a weaker economy could also hit the demand for defense and aerospace stuff. The stock’s valuation is also a factor, with some analysts seeing less room for big jumps, according to Yahoo Finance UK.

Rolls-Royce Stock Forecast

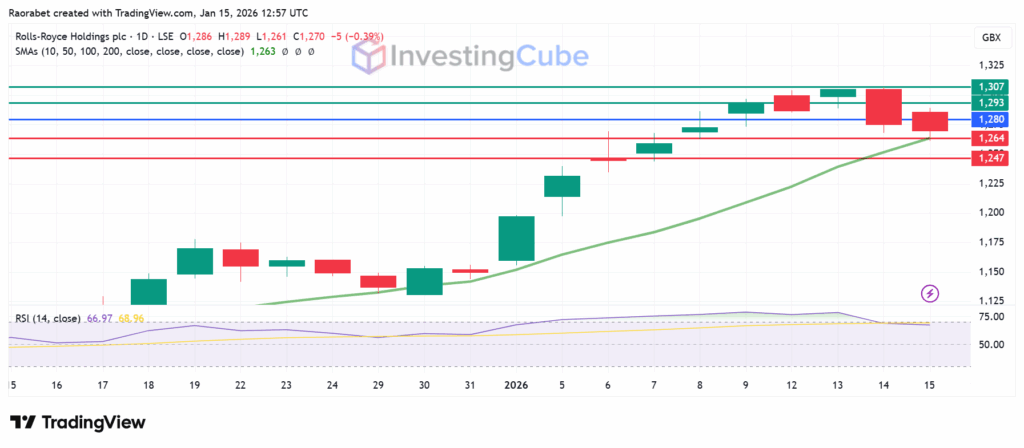

Rolls-Royce stock is currently navigating a healthy reversion after hitting overbought levels. The Relative Strength Index (RSI) has recently cooled from an extreme overbought reading of 74 down to 66. Immediate resistance is firmly established at 1,293p, beyond which it could target the recent all-time high of 1,307p. On the downside, strong support is found at the 10-day SMA of 1,264p, with a deeper one at 1,247p.

Rolls Royce stock on a daily chart on January 15, 2026 with support and resistance levels created on TradingView

It is primarily profit-taking. After a 15% run in a month, the stock became “technically overbought.” Without a new immediate catalyst, traders sold positions to lock in gains, leading to a natural price correction.

Unlikely to double again due to elevated valuations limiting upside, though modest growth of 10-20% is possible if execution in aerospace and defense remains strong.

Defense provides revenue visibility. Geopolitical tensions in Europe and the Middle East have led to increased military budgets, securing long-term contracts for Rolls-Royce’s engine and nuclear propulsion divisions, which acts as a hedge against civil aviation cycles.