- Rolls Royce stock price has been struggling for momentum recently and traders are hoping that this week's trade update could provide clarity.

Rolls-Royce Holdings plc (LSE: RR.) has grabbed investors’ interest this year because of its remarkable comeback, but the last week has been a bit shaky. The stock price danced around between 1,116p and 1,142p, and finally closed at 1,138.50p on November 7. This up-and-down movement is because of the recent jitters in the market, thanks to what’s going on worldwide with the economy. Still, the stock’s skyrocketed over 100% this year, which shows how strong it is in the plane and defense business. Let’s try to figure out what all this means.

The week started with a small drop to 1,131.50p on November 6, but then it bounced back a bit. There was insider buying of shares, and there was news about a big £2.5 billion nuclear deal, which helped. Yes, there are worries about tariffs and fewer people traveling, but the main story is still good. The first half of the year saw profits jump 32%, and planes are flying more now than before 2019. Therefore, it looks like this dip might just be a blip, not a change in direction.

Trading Update and Its Potential Impact

For those who are in it for the long haul, Rolls-Royce is still in the middle of turning things around, especially turning engine servicing profits into a money-making machine. With November 13 coming up quick, everyone’s wondering how much the stock will move. The update on the 13th isn’t a full report, but more like a quick look at how things are going.

Experts think the Q3 statement will say things are still on track for the year. The Motley Fool thinks revenue will be around £19.6 billion, which is about an 11% increase, and profits could reach £3.3 billion. Hargreaves Lansdown points to a £100 billion+ order book and the strength of the defense part of the business as things that could boost growth.

Interactive Investor mentions that Rolls-Royce is doing better than other big companies in the UK, because they’re watching costs and their service business is solid. If all this is true, the stock could jump way above where it’s been recently.

But, there might be some bumps in the road, which is why the stock price has been a bit weird lately. One big issue is the ongoing global supply chain problems. The company already said they’re having trouble with delays on materials and parts, not enough workers, and rising repair costs.

Rolls Royce Share Price Prediction

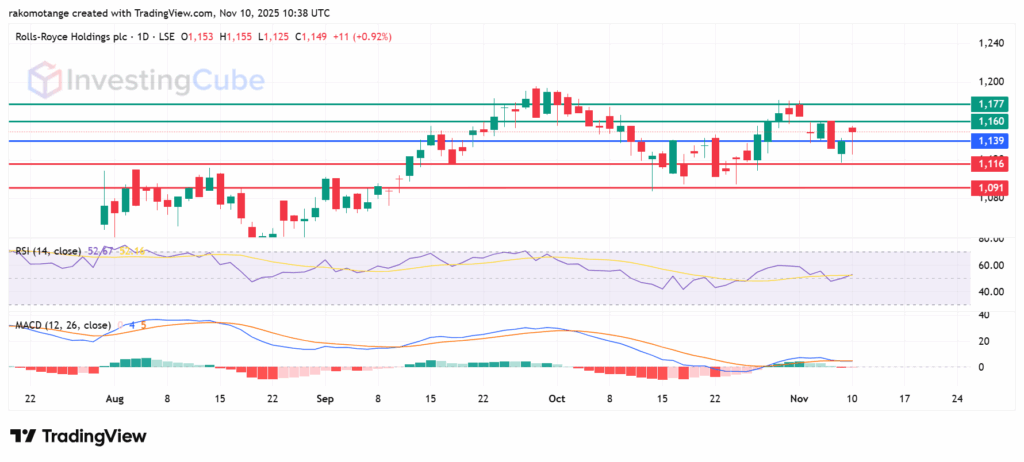

Looking at the stock charts, things seem positive. The RSI is at 52.67, which signals a momentum strong enough to keep things going up. Moreover, the MACD is rising, adding credence to the bullish outlook. Rolls Royce share price will likely meet initial resistance at 1,160p. A break past that could push the action higher to test 1,177p. On the downside, action below 1,139p pivot will favor the sellers to be in control and likely find initial support at 1,116p. A break below that point could send the stock lower to test 1,091p.

Rolls Royce stock on November 10,2025. Source: TradingView

What do momentum indicators reveal about Rolls-Royce stock outlook?

The RSI at 52.67 sits in neutral territory, avoiding overbought risks, while MACD rise confirms growing upside momentum.

How might the market react if the Rolls Royce trading update merely meets the already upgraded financial guidance?

If the update only meets expectations, the Rolls Royce stock may see investors engage in profit-taking. The company’s current valuation has priced in significant optimism, leaving little room for a merely satisfactory result.

Rolls-Royce is no longer just an engine maker, but a high-margin service business in aerospace and defense. The management’s focus on efficiency and a growing order book signals a structural shift that will likely reward patience.