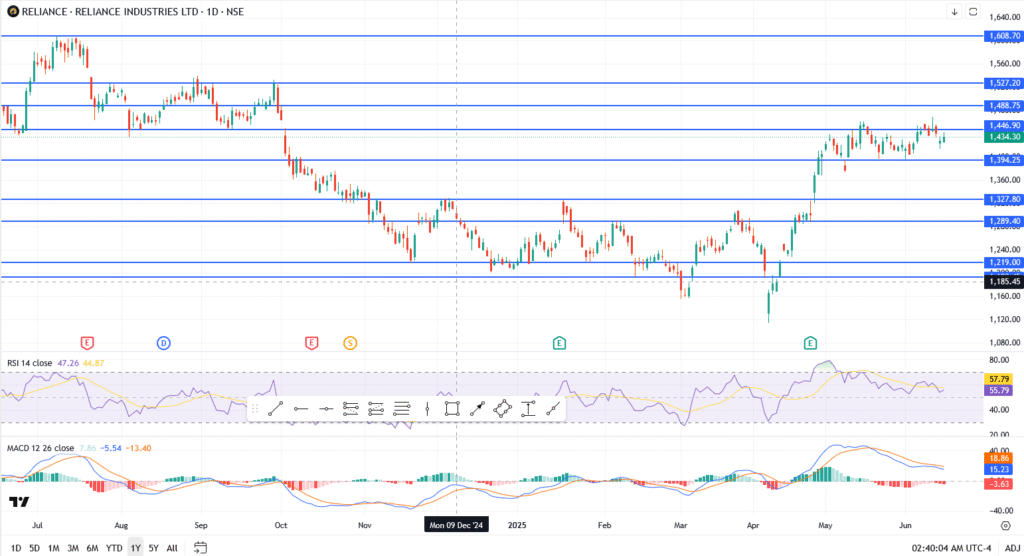

Reliance Industries is entering the week flat, with its share price stalling near ₹1,438 after failing to hold Friday’s high. The stock is still up roughly 15% over the last quarter but has struggled to reclaim momentum above the ₹1,453 pivot zone. With volumes thinning and sentiment mixed, bulls are running out of room and time.

Reliance began Monday’s session with a brief spike to ₹1,441 but has since faded, echoing the indecision seen across broader Indian equities. The stock remains locked in a narrow range, with buyers repeatedly stepping in at ₹1,420, but momentum above ₹1,453 has proved elusive. That zone has now been rejected three times in the last nine sessions, and traders are starting to notice.

The move follows last week’s pressure, triggered partly by the firm’s high-profile divestment of its Asian Paints stake. While the sale netted a hefty return, nearly 23x from its original 2008 investment, it also raised eyebrows about where Reliance might redeploy that capital. So far, there’s been little clarity.

Technically, the chart is holding up. Reliance has built a short-term base above ₹1,420, but that support won’t hold forever if bulls remain passive. The longer price churns below ₹1,453, the higher the risk of profit takers stepping in to unwind gains made since April.

The RSI sits at 55, neutral. MACD has turned flat. If the stock breaks below ₹1,420, it could quickly revisit the ₹1,394 zone, a level that held in May. On the upside, a clean close above ₹1,453 would invalidate the bearish structure and reopen the path to ₹1,470.