Shares of Reliance Power Ltd (NSE: RPOWER) exploded higher in Friday’s session, soaring over 16 per cent intraday to hit a fresh 52-week high of ₹60, as traders piled into the counter amid unusually strong volume and technical momentum. The rally adds to an already stellar run in 2025, with the stock now up more than 40 per cent this month alone.

At the time of writing, over 9 crore shares had changed hands, significantly higher than the stock’s 20-day average. Market watchers attribute the surge to a combination of short covering, bullish sentiment across power stocks, and improving technical signals.

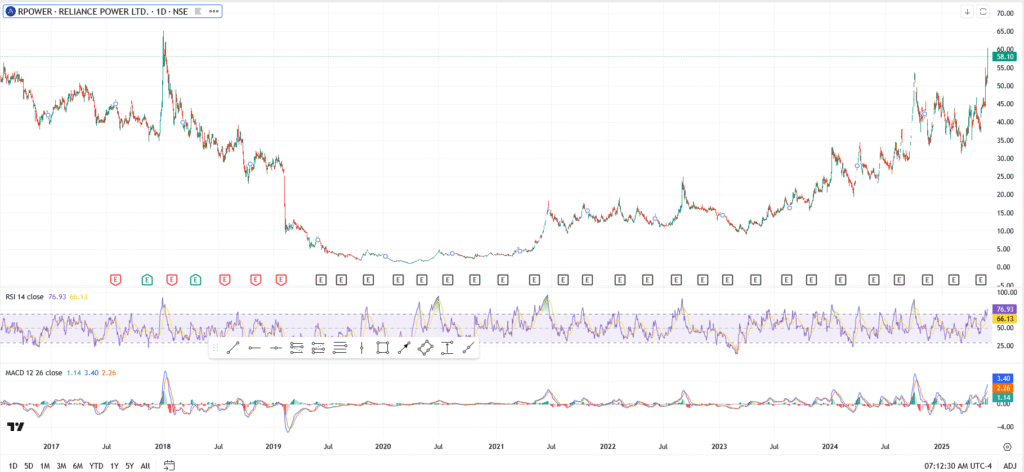

Reliance Power Shares Chart Analysis

Technically, this is a clean breakout. The stock cleared resistance near ₹54 earlier this week and has now made a fast move to ₹60. RSI is at 76.93, stretched but still holding. MACD is climbing, with no sign of bearish divergence yet.

If price holds above ₹55, the next area of interest could be ₹65, followed by ₹72. Any dip back to the ₹52–₹54 zone might find support, especially if volume stays healthy.

Is Reliance Power Still a Penny Stock?

This isn’t just a random price spike. If the momentum is backed by real progress on things like asset sales or debt repayments, the rally could go further. For short-term traders, the volume is what matters now. If we start seeing strong delivery-based buying, it could mean bigger players are quietly stepping in.

For long-term investors, there’s still some baggage. Reliance Power’s financial past hasn’t exactly inspired confidence. But the way this stock is moving now, it’s different. And with energy and infra names gaining traction across the board, this might be the beginning of a new phase. It’s too early to call it a comeback, but it’s no longer trading like a penny stock with no direction.