Indian billionaire Mukesh Ambani’s Reliance Industries (NSE: RELIANCE) is in focus today after the conglomerate executed a major block deal, selling shares worth $895 million in Asian Paints. The transaction was picked up largely by domestic institutions, including SBI Mutual Fund, marking one of the largest stake sales of 2025.

The move is seen as part of Reliance’s ongoing capital rotation strategy, likely aimed at unlocking value and shoring up liquidity for expansion in green energy and telecom. Investors are now watching how India’s richest person, Mukesh Ambani, reallocates these proceeds as the company tightens its focus on its new-age verticals.

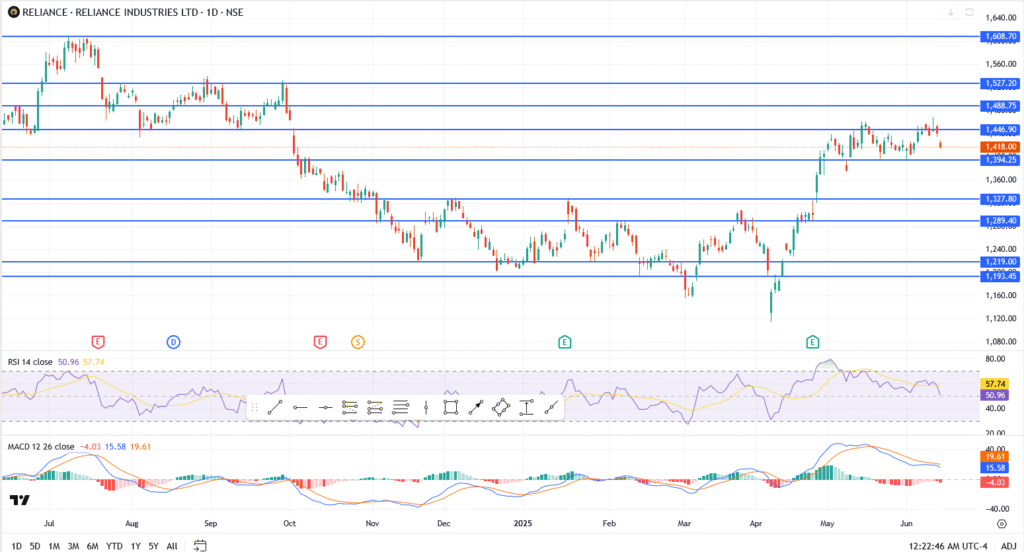

Reliance Industries Technical Analysis: ₹1,394 Support Still Intact

From a technical standpoint, Reliance Industries’ share price remains rangebound but stable. The stock is consolidating between ₹1,394 and ₹1,446.90, forming a short-term base above the May breakout. As long as ₹1,394 holds, bulls remain in control.

- Immediate support: ₹1,394

- Resistance zone: ₹1,446.90

- RSI: Neutral at 50.96

- MACD: Mild bearish crossover, but no strong downside pressure yet

A break above ₹1,446.90 may open the door for a run toward ₹1,488. Below ₹1,394, weakness could extend toward ₹1,327.80. For now, India’s richest person, Mukesh Ambani, appears to be playing a strategic game, and the market is watching his next move closely.