Raymond Ltd (NSE: RAYMOND) shocked investors on Wednesday with a dramatic 66% plunge in its share price, falling from around ₹1,600 to ₹551 in a single session. At first glance, the drop looked like a market rout, but the reason is more technical than fundamental.

Market confusion was triggered by the listing of Raymond Ltd’s real estate business separately under “Raymond Realty Ltd.” In contrast, the demerged business was relisted under Raymond – Dep Sett, causing the base stock to appear to crash. This isn’t a price collapse in the usual sense. It’s the result of a demerger adjustment.

Still, the chart damage is real. And traders who weren’t aware of the corporate action were left scrambling.

What Caused Raymond Shares to “Crash”?

The steep fall is linked to a corporate restructuring, not a collapse in business operations.

- Raymond demerged its real estate business into a new entity, Raymond Realty Ltd, which is now separately listed.

- The textile and lifestyle businesses continue under Raymond – Dep Sett, which is what traders saw tank today.

- Because of this realignment, the original stock’s price reflects only the remaining business, not the combined group valuation.

This often happens in spin-offs and demergers, but the sudden visual drop on trading screens, without clear intraday labelling, spooked retail traders and triggered panic selling in some corners.

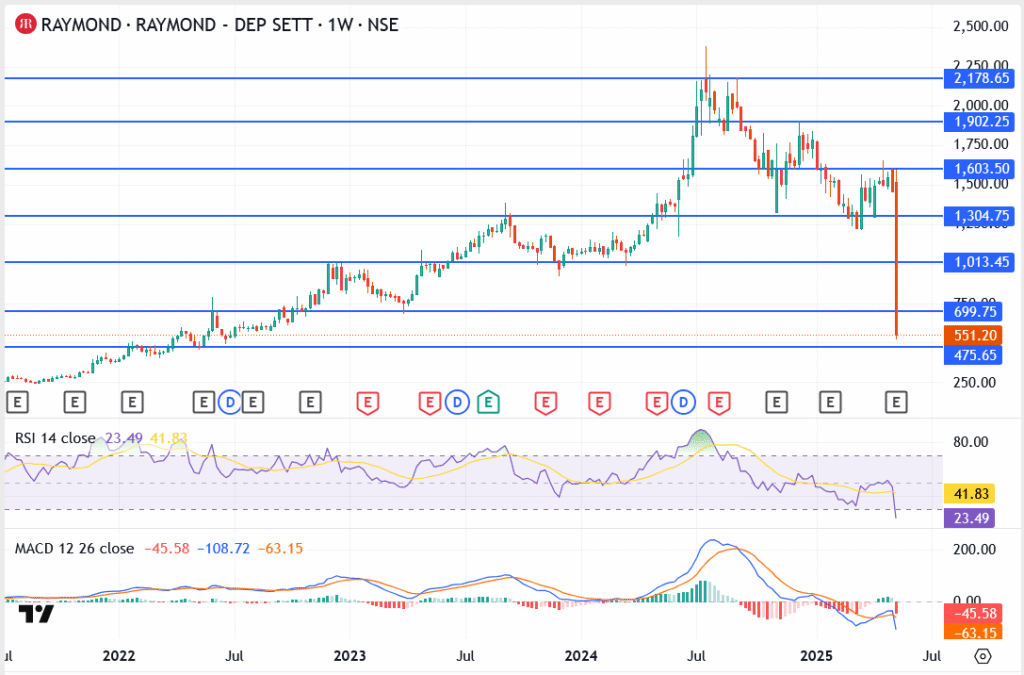

Raymond Share Price Technical Breakdown: Blood on the Chart

- Price collapsed straight through ₹1,304.75 and ₹1,013.45, without any pause

- Landed hard at ₹551.20, which now acts as the first stabilisation zone

- Next downside level lies at ₹475.65 if today’s level gives way

- RSI crashed to 23.49 – deeply oversold territory

- MACD shows sharp bearish divergence with both signal lines below -45

- Recovery only begins if price reclaims ₹699.75 – still a distance away

The sudden plunge broke months of structure. Despite the corporate action, chart-based traders will now treat this as a deep technical reset.

Outlook: Short-Term Volatility, Long-Term Repricing

The dust hasn’t settled. Even though the crash wasn’t operational, price discovery will take time as the market reassesses Raymond’s standalone value post-demerger.

Expect increased volatility in the coming sessions as traders digest the real estate separation, and analysts revise sum-of-parts valuations.

Retail investors may want to avoid chasing any bounce until volumes stabilise and the stock finds a new range.