Pfizer share price rallied 12% hitting ₹5,097.40 on the NSE. After the company posted a solid set of Q4 numbers and declared a massive ₹165 per share dividend, including two special payouts.

The pharma major reported a net profit of ₹330.94 crore for the March 2025 quarter, an 85 per cent jump compared to ₹178.86 crore in the same period last year. Revenue rose 8 per cent year-on-year to ₹591.91 crore. The board also approved a ₹35 final dividend, ₹100 to commemorate 75 years in India, and ₹30 as a one-time special payout from land-related gains. This announcement was made after the board meeting held on May 19.

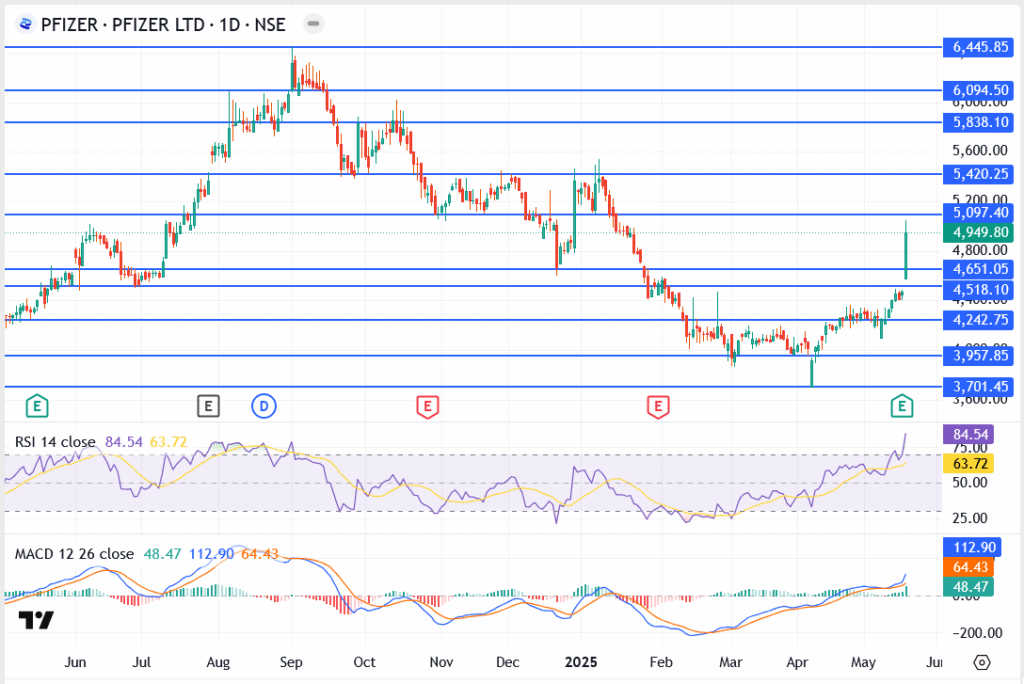

Pfizer Share Price Technical Analysis

- Price broke above key resistance at ₹4,651.05 — now flipped to support

- Intraday high at ₹5,097.40 — testing immediate supply zone

- Next resistance is ₹5,420.25 — a previous top from last year

- RSI is at 84.54 — deeply overbought, indicating possible near-term cooling

- MACD is bullish — strong upward crossover with widening gap

- Price is now above 5, 10, and 30-day moving averages — short-term trend is positive

- Still below 50 and 200-day MAs — long-term breakout not confirmed yet

Outlook

The sharp rally in Pfizer share price today has been backed by strong earnings and an unexpectedly large dividend, which has shifted sentiment firmly in favour of the bulls. That said, the stock looks slightly stretched after today’s big move.

With momentum indicators running hot, some profit-taking or range-bound action can’t be ruled out in the short term. If Pfizer manages to stay above ₹4,800, the overall setup still looks healthy. A strong push past ₹5,100 could open the way toward ₹5,420 in the days ahead.