- PC Jeweller share price rose so sharply in the last two days that it triggered ASM and there's good reason to expect the upside to prevail.

PC Jeweller share price took a breather from its upside momentum on Tuesday, going down by 4.01% to close at ₹17.97. The stock rose sharply by 31% in the last two sessions on strong Q1 performance which defied volatile gold prices to beat analyst forecasts as shared here. Despite today’s losses, the sentiment surrounding the stock has a bullish undercurrent supported by a robust outlook for FY 2026.

Notably, the big jump in the previous two trading sessions triggered a reaction from the BSE and NSE which placed it under Additional Surveillance Measures (ASM). Under ASM, retail traders must fulfil strict rules like 100% margin requirement as well as mandatory trade-for-trade settlement. That puts downward pressure on stock prices and translates to higher levels of short-term liquidity.

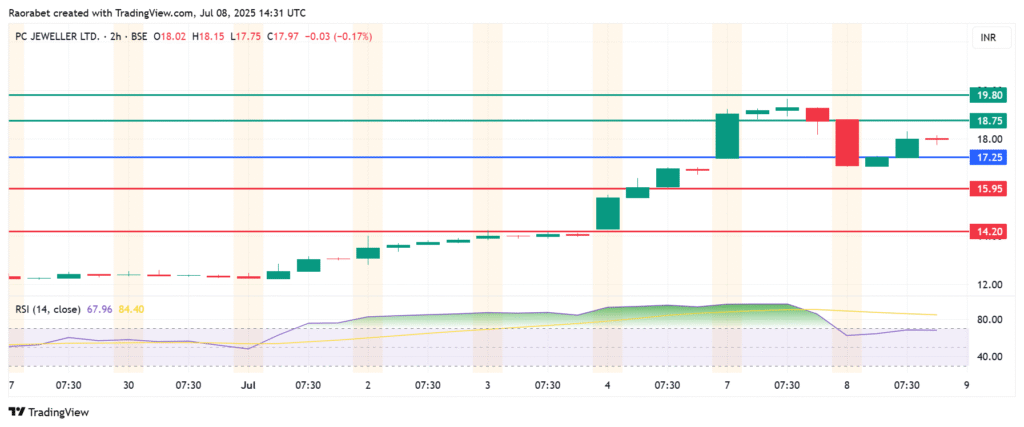

Therefore, the ASM decision likely informed some investors’ decision to tame their appetite for PC Jeweller share price, much as profit booking was also in play. That said, there remains a bullish undercurrent on the stock, with the MACD above the signal line and the RSI reading at 81.

The company’s fundamentals remain strong and it recently attributed its impressive earnings in Q1 to strong demand during India’s wedding and festival season, which defied the high volatility of gold prices during that period.

However, on the downside, gold prices have retreated in the last two sessions and barely holding above $3,300 support. A continuation of that trend looks likely amid shifting interest rate expectations, and could limit the upside for PC Jeweller (BSE: PCJEWELLER) share price.

PC Jeweller Share Price Prediction

The momentum on PC Jeweller share price calls for the upside if the price stays above ₹17.25. The stock will likely meet initial resistance at ₹18.10. A stronger momentum will break above that level and likely encounter the next barrier at ₹19.80.

Alternatively, breaking below ₹17.25 will invite the sellers to take control. In that case, the momentum will move downwards and likely find primary support at ₹15.95. The upside narrative will be invalid if the price breaks below that level. Also, an extended control by the sellers could extend the downside and test ₹14.20.