Following a spectacular 500% run over the previous year, Palantir Technologies (NYSE: PLTR) is beginning to show signs of weakness. As investors start to question if the artificial intelligence can continue its exponential climb, the stock fell more than 4% this week, losing around $6 billion in market value.

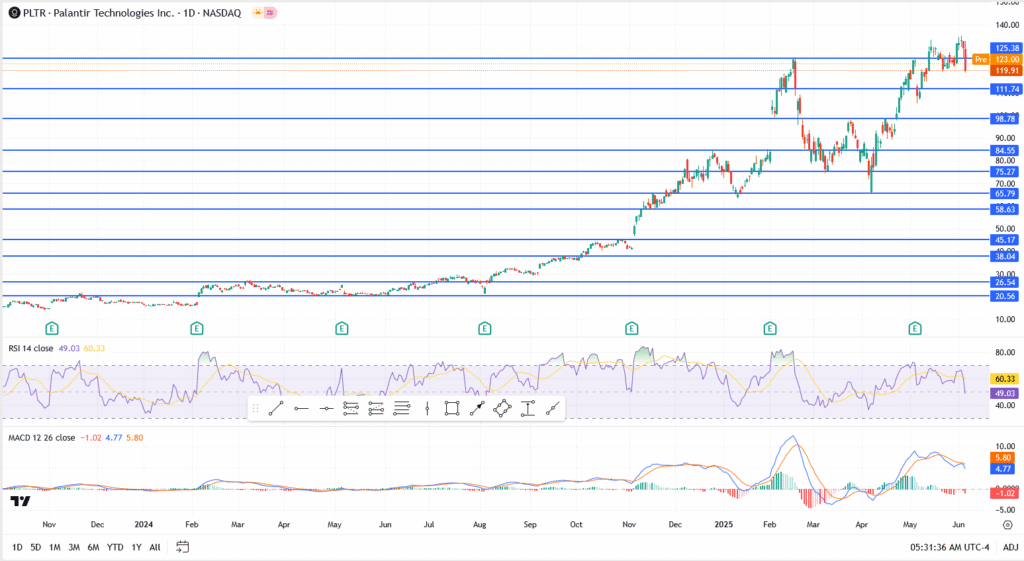

Shares closed at $119.91 on Thursday, down from highs above $125.38. The pullback marks one of the first notable dips in months for the AI-fueled data analytics firm, a name that’s become synonymous with government tech contracts and battlefield intelligence tools.

Palantir vs. Snowflake: Which AI Stock Has More Room to Run?

Analysts are starting to shift their attention toward Snowflake (SNOW), a data cloud rival with a less flashy chart but arguably more stable fundamentals.

Snowflake, by contrast, is seen as the more reasonably priced growth play, especially in enterprise segments where Palantir has struggled to gain serious traction.

Palantir Key Technical Levels to Watch

- Immediate support now sits at $119.91. A break below that could trigger a move toward $111.74

- MACD histogram is fully red; bearish momentum building

- RSI has fallen from overbought highs to 49, signalling loss of strength

- Bulls must reclaim $125.38 to regain upside control

Outlook: Tired, Not Broken

Palantir is still one of the most recognised names in the AI space, but the market may be entering a phase of recalibration. Any delay in government contract wins or AI-driven revenue could lead to additional volatility because expectations are so high.

PLTR is still in the lead for the time being, but the honeymoon period might be coming to an end. The question is whether the market needs a cooling off period before it can believe again, or if fundamentals will drive the next wave upward.