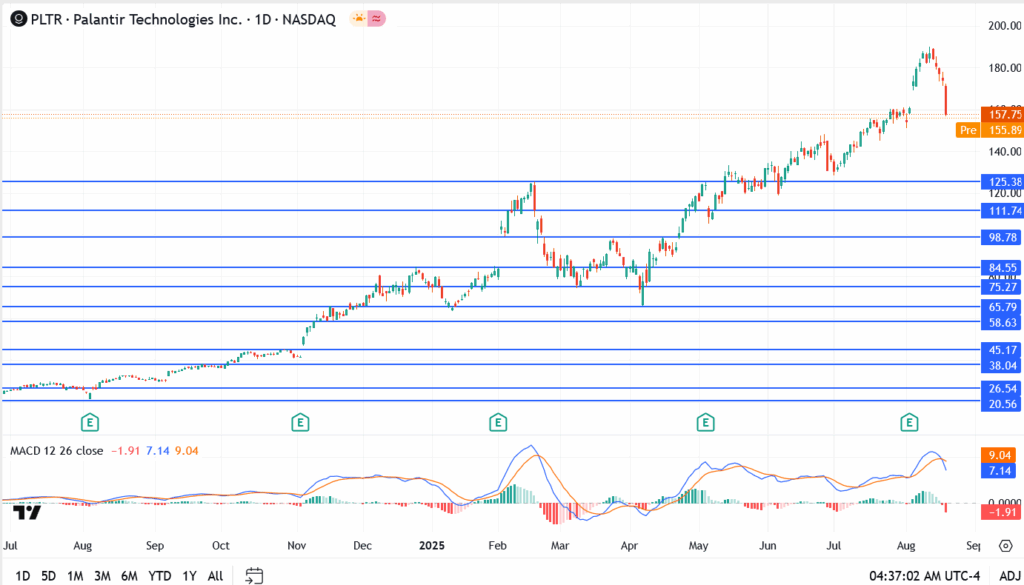

- Palantir stock fell 7% Tuesday and slid further pre-market Wednesday. Key support sits near $156 with $166 resistance.

How is Palantir stock trading ahead of Wednesday’s open?

Palantir shares slumped 7% on Tuesday, their sharpest one-day drop since March, as profit-taking caught up with the AI-fueled rally. The stock, which had sprinted to fresh all-time highs earlier this month, slid to close near $157. Pre-market trade on Wednesday shows the weakness spilling over, with bids struggling to hold the $156–$157 zone.

The correction doesn’t erase the bull story that powered Palantir into the $180s. AI contracts remain robust, and government pipeline visibility is improving. But at these heights, traders are weighing whether near-term valuations already reflect the good news. The $180 breakout quickly turned into resistance once momentum cooled, suggesting the market wants confirmation before rewarding further upside.

Tape action yesterday was more profit-taking than panic. Selling was controlled, and buyers sat lower on the book. That’s consistent with a consolidation phase near highs, not a broken trend.

Palantir Stock Technical Analysis

- Current price: $157.75 (pre-market $155.89)

- Pivot level: $156

- Immediate resistance: $166, then $175

- Support: $155, then $148; deeper cushion at $125.38

The stock is hovering right on its pivot. A firm reclaim of $166 would reassert upward momentum, targeting $175. Failure to defend $156 opens the door to $155, and a decisive break there risks a drift toward $148. A deeper pullback could stretch toward the $125 shelf, where the prior consolidation base sits.

Can Palantir Rebound Quickly?

The AI story around Palantir hasn’t gone away, but investors want to see hard evidence that earnings can keep up with the hype. That means clear beats and steady contract wins, not just headlines. The stock still has dip buyers circling near $156, but until it can put in a couple of strong closes above $166, the mood is less about chasing momentum and more about waiting for proof.