Nvidia (NASDAQ: NVDA) is up 1.2% in pre-market trading on Thursday, July 24, 2025, building on its remarkable summer rally as investors pile back into AI-heavy tech stocks. The stock closed Wednesday at $170.78 and is now trading at $172.66 pre-market, just below key resistance levels. With earnings due in under a month, Nvidia’s momentum is once again being driven by macro-level AI optimism and strong signals from its global supply chain.

SK Hynix Stock Rallies on Record Profits, Lifting Nvidia AI Outlook

South Korean chipmaker SK Hynix, a key supplier to Nvidia, surged after posting record quarterly earnings and announcing a significant expansion of its capital expenditure for 2025. This bullish update reaffirms robust demand for AI memory chips, bolstering confidence in Nvidia’s supply resilience.

The timing couldn’t be better. Washington’s newly proposed AI export blueprint, which aims to ease regulatory restrictions on chip sales to non-hostile nations, has also added to the tailwind. For Nvidia, that means a broader global sales runway, just as AI infrastructure demand continues to accelerate.

Morgan Stanley Names Nvidia a Top Pick Before August Earnings

On the institutional front, Nvidia received another credibility boost after Morgan Stanley reiterated it as a “top pick” ahead of its Q2 earnings report scheduled for August 21, 2025. The firm pointed to stronger-than-expected GPU demand, improving supply chains, and Nvidia’s commanding lead in data center AI infrastructure.

That endorsement adds weight to the growing conviction that Nvidia’s rally isn’t done yet. The Street will be watching closely for forward guidance and updates on the rollout of the new Blackwell chips, which could become a key earnings driver in the second half of the year.

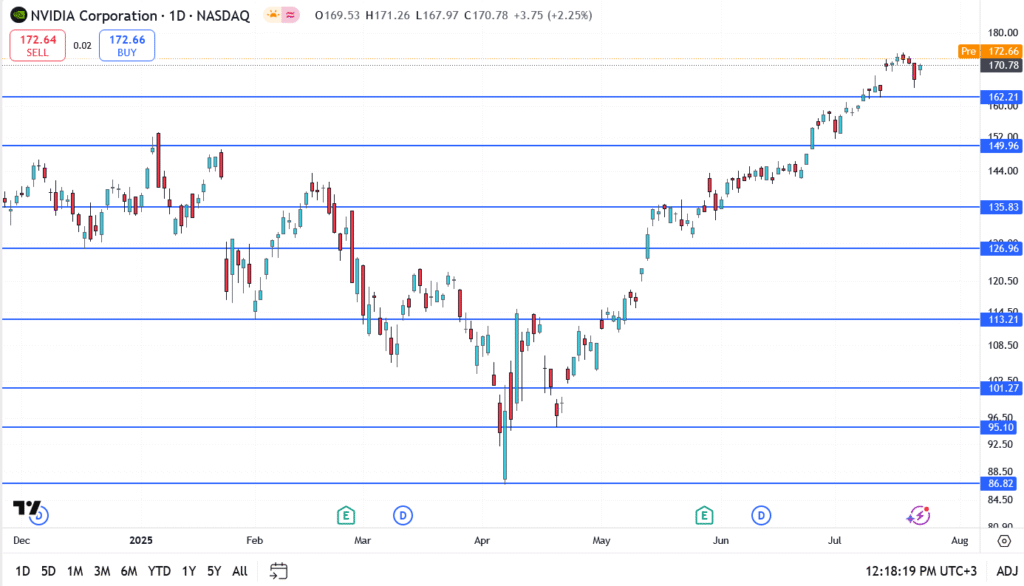

Nvidia Share Price Technical Analysis

- Current price: $170.78

- Pre-market: $172.66

- Resistance levels: $176.40, $180.00

- Support levels: $162.21, $149.96

Outlook: Nvidia’s AI Story Still Has Legs

Nvidia isn’t just riding a hype wave, it’s riding a well-funded, policy-backed AI supercycle. With SK Hynix firing on all cylinders and Washington making life easier for chip exporters, the setup heading into earnings looks solid. Sure, there might be a few wobbles on the way, but unless Nvidia delivers a major earnings disappointment, dip buyers are likely to stay active. If momentum holds, the $180 barrier could be toast before earnings even hit the wire.