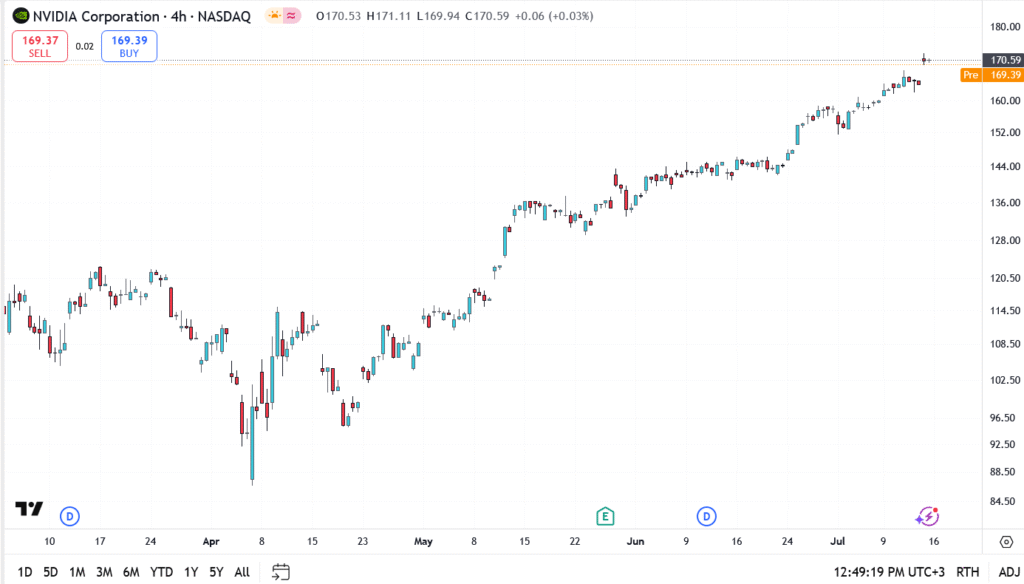

Nvidia share price traded slightly higher on Tuesday afternoon, hovering near $170.59 after a strong open that briefly pushed the stock above $171. The move follows reports that China has resumed limited chip imports from U.S. firms, including Nvidia, as part of a broader de-escalation under the new trade agreement.

That news helped propel NVDA stock to fresh highs, capping a stellar run that has seen the AI chipmaker rally more than 35% in the last six weeks. Institutional flow remains firmly bullish, with investors betting on another demand surge if the China supply channel reopens fully.

The FXLeaders report suggests U.S. chipmakers have been granted initial clearance to ship select AI and data center units to Chinese cloud firms. While details are still emerging, the market took it as a clear signal that geopolitical tensions may be cooling.

Nvidia Stock Technical Analysis

- Current price: $170.59

- Resistance levels: $173.40, then $180

- Support levels: $166.80, then $160.50

As long as price stays above $166.80, the bulls are in control. A clean breakout above $173.40 could open the path toward $180 in the coming days, especially if more clarity emerges from Washington or Beijing.

Outlook: Geopolitics Meet AI Hype

With Nvidia already a top beneficiary of the AI boom, any thaw in U.S.–China relations supercharges its international growth prospects. Traders are now eyeing $180 as the next magnet, with options flows suggesting bullish bets are piling in ahead of Nvidia’s next earnings cycle.

If the current rally holds, Nvidia could soon approach the higher end of Wall Street’s projections for the quarter, fueled by strong chip demand, improving trade sentiment, and supportive market conditions