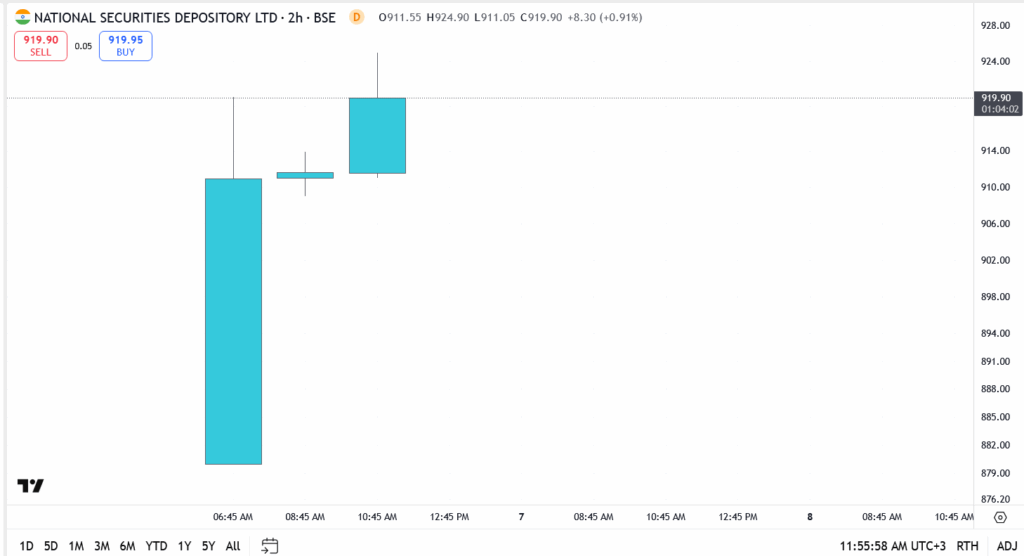

After listing at ₹880 on debut, NSDL shares extended their gains on Wednesday, trading near ₹920 by mid-session. The stock briefly touched ₹924.90 before cooling off slightly, showing steady follow-up demand post-listing. The price action suggests that early investors are still holding, while fresh entrants continue to chase upside momentum.

The ₹4,000 crore IPO didn’t struggle for attention. Big money showed up early, institutional players piled in hard, with QIB bids crossing the 100x mark before the books even cooled. Retail investors didn’t wait around either. By the time the offer closed, demand across categories had turned this into one of the most crowded listings of the year.

NSDL IPO Analysis

- Current price: ₹919.90

- Open: ₹911.55

- Day high: ₹924.90

- Day low: ₹911.05

- Change: +₹8.30 (+0.91%)

- This is Day 2 of listing, and price action shows follow-through buying after the debut.

NSDL didn’t spike wildly out of the gate, and that might be a good thing. After hitting an intraday high of ₹924.9, the stock cooled off slightly, with profit-taking kicking in above ₹911.55. Still, it stayed well above the offer price through the morning session.

Key Levels to Watch for NSDL

- Current price: ₹919.90

- Immediate support: ₹900, then ₹880

- Resistance: ₹925, then ₹950

- Bias: Still bullish, but cooling near resistance

NSDL is hovering just below ₹925 after a strong Day 2 follow-through. ₹900 has started acting as an intraday base, while ₹880, the listing level, now serves as a key psychological floor. A decisive push above ₹925 could trigger fresh momentum toward ₹950. If the stock fails to hold above ₹900, some near-term profit-taking could follow.

NSDL isn’t a flashy name, but it doesn’t need to be. As one of India’s core depositories, its business is predictable, profitable, and tied to the long-term growth of capital markets. With tech-led efficiencies, high margins, and near-zero churn, this is the kind of stock long-only funds tend to hold quietly, and for years.

The valuation gap with peer CDSL will also be watched closely in the coming weeks. While both operate in the same space, NSDL has the older pedigree and deeper institutional relationships, which could eventually reflect in pricing.

Conclusion

No drama. No frenzy. Just a clean listing that rewarded patient bidders and gave the market a steady hand to start with.

Whether NSDL goes on to outperform will depend on how it executes in a maturing capital market cycle. For now, it’s off to a stable, confident start, and that might be exactly what this market wanted.