- Nio stock price has risen by more than 75% since July and its aggressive entry in the mass market is certainly paying off. But there's more.

Nio Inc. (NYSE: NIO), a Chinese electric vehicle (EV) maker, has seen its stock price go up more than 75% since July 2025, going from around $3.50 to about $6.22 as of this writing. This momentum picked more speed in the second half of the year, thanks to strategic product introductions and strong delivery figures as China’s EV rivalry heated up.

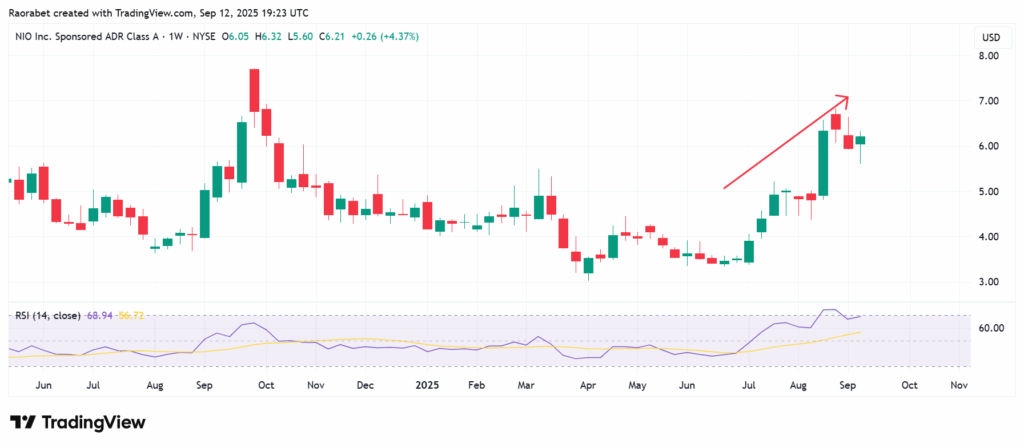

Nio stock price has been on a strong uptrend since July as seen on this TradingView chart

What’s Behind the H2 Propulsion?

The spike by Nio stock price is because the company is aggressively moving into lower-priced markets to compete with companies like BYD and Tesla. Nio unveiled the ONVO L90, the entry-level SUV from its sub-brand, in late July. It costs less than RMB 200,000 ($28,000) and is aimed at families.

Meanwhile, deliveries of more than 4,000 units in 10 days showed that there was a lot of initial demand. Then, in August, the Firefly brand launched a small SUV geared at young urban adults. By the end of the year, it plans to expand into 20 European countries.

The market has responded well to Nio’s new cars, especially the ONVO L90 and the new ES8 SUV. The ONVO L90, which is part of Nio’s sub-brand for the general public, has sold well so far, with thousands of devices shipped in its first full month.

The new ES8, a high-end SUV, is also expected to bring in more sales with higher margins, which is important for the company’s overall profitability. August was the best month, with 31,305 vehicles delivered, a 50% increase from July. Half of those sales were ONVO models.

The updated ES8 flagship SUV also helped, increasing sales in the premium sector. These changes helped Nio gain more market share in China’s high-end electric vehicle industry, where it sold 72,056 cars in the second quarter of 2025, a 25.6% increase from the same time last year. Nio was able to stand out even more with battery-swapping technology, which has more than 2,500 stations throughout the world. This helped reduce range anxiety and made it easier for people in cities to use the cars.

Investor sentiment around Nio stock price changed for the better when institutional inflows came back, seeing these launches as a sign that sales were picking up after a period of stagnation. In line with that, top analysts like JPMorgan, have raised their ratings and targets for Nio stock.

This shows that they are more confident in the company’s capacity to implement its strategy and compete in the market. The sharp rise in Nio stock price is a welcome change for the Chinese electric vehicle (EV) maker following a time of losses and turbulence, but what does the future hold?

Nio’s Growth Outlook

The company’s targets for car deliveries are high; for Q3, they aim to deliver up to 91,000 vehicles, and for Q4, they plan to deliver even more. Nio’s path seems good yet unsettled, and analysts expect it to grow faster through 2026. As the global market for EVs grows to 20 million units, Nio is projected to potentially deliver 330,000 units in 2025, double the figure registered in 2023.

New models and a global push are predicted to push revenue up 36–49% to ¥89.3 billion ($12.3 billion) in 2025. That figure could rise up 40–41.5% to ¥124.7 billion ($17.2 billion) in 2026. If Nio can reach these targets, it will demonstrate that it can increase output and satisfy rising demand, which is a key sign of long-term success.

The move into sub-brands like ONVO and Firefly is a long-term strategy to reach more customers and create a complete ecosystem for electric vehicles. The plan aims to make the company less dependent on the high-end market and to establish new ways to make money.

Meanwhile, Nio is still putting a lot of money into its fundamental technology, such its own battery swapping network. This “battery-as-a-service” (BaaS) approach is a big part of what sets the company apart. It could help with range anxiety and bring in money on a regular basis, which would make the company’s finances even stronger in the future.

But there are still risks. High debt, trade tensions between the U.S. and China, and fierce competition in the EV market could all put pressure on margins. Overall, Nio’s H2 catalysts put it in a good position for substantial growth, but it will be very important to follow through on cost cuts. Potential investors who are putting their money on Nio’s “Tesla of China” status may profit from price drops.

Record sales, battery-swapping tech, and sub-brand expansions have enabled Nio to counter rivals like BYD.

Nio’s outlook is focused on increasing vehicle deliveries and achieving profitability through improved margins and strategic cost controls.

Nio intends to diversify its product offerings by introducing new sub-brands such as ONVO and Firefly, and by capitalizing on its innovative battery swapping technology.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.