- Netflix earned $12.05 billion in revenue and posted an EPS of $0.55, beating analysts' forecasts on both metrics

- The company's stock traded downwards in after-hours session, attributed to a soft guidance for Q1 2026

- Warner Brothers Discovery acquisition continues to be the largest source of pressure as debt concerns mount

Netflix’s (NASDAQ: NFLX) recent performance is interesting. The company’s fourth-quarter 2025 earnings surpassed Wall Street’s estimates across almost all key figures. Still, the stock is struggling, down about 7% so far this year as it deals with an $82.7 billion cash offer for Warner Bros. Discovery’s (WBD) studio and streaming assets. We discuss how the latest earnings might ease some pressure and start a recovery, and what the acquisition could mean moving forward.

Is the Worst Over for Netflix Stock?

The recent earnings provide grounds for optimism. Netflix reported Q4 revenue of $12.05 billion, better than the $11.97 billion forecast by analysts. Earnings per share were 56 cents, marginally higher than the 55 cents forecast. They now have over 325 million paid subscribers worldwide, up from 300 million in late 2024, thanks to popular shows like Stranger Things and NFL games. Ad revenue for 2025 was over $1.5 billion, more than double what it was in 2024.

Yet, even with these great results, the stock dropped after hours. It seems investors are worried about the “soft” guidance for the first quarter of 2026 and the sheer size of the Warner Bros. deal.

A rebound appears plausible if earnings momentum overrides acquisition uncertainty. Netflix expects $51 billion in revenue for 2026, a 14% increase. They also predict ad revenue will double to $3 billion and an operating margin of 31.5%. Some analysts believe that settling the acquisition could boost investor confidence, as Netflix often sees its stock rise after earnings reports.

Yet, challenges persist. The stock is down 30% from its mid-2025 highs, partly because of the risks of the deal, including a possible $5.8 billion breakup fee if it’s blocked. If regulators approve the deal, the stock could go up, maybe even reaching its previous highs. But if Paramount’s offer of $30 per share wins, Netflix would avoid taking on debt but could miss out on strategic benefits.

Will the Warner Brothers Discovery Hangover Haunt NFLX Price Throughout 2026?

Whether a rebound is imminent depends on your time horizon. The earnings report shows that Netflix’s core business is strong, generating over $1.8 billion in free cash flow last quarter. Now the market sees Netflix as a media giant, and that brings with it added downward pressure.

Netflix Stock Price Forecast

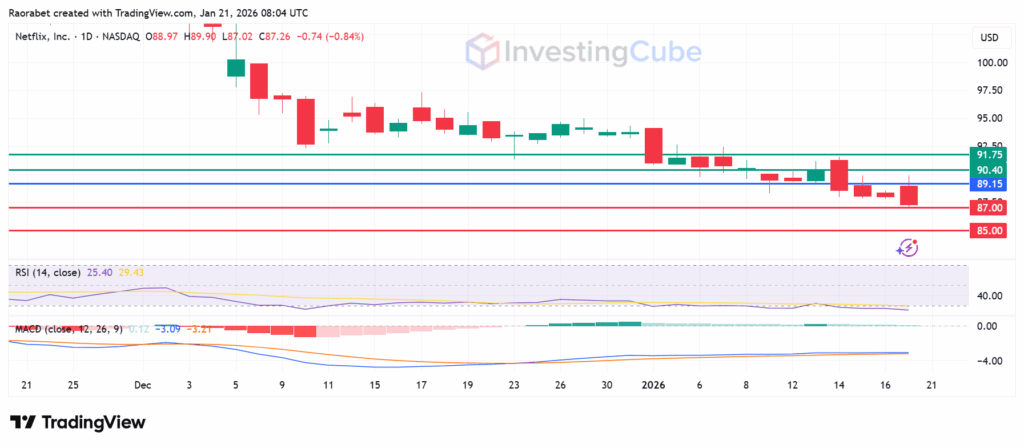

Netflix stock price is currently testing a critical support level at $87.00. The Relative Strength Index (RSI) is hovering near 25, signaling that the stock is technically oversold. Also, MACD bearish at -3.09. A sustained break below the first support could see the stock slide toward the $85.00 zone. Conversely, resistance is firmly established at $90.40, with a more significant ceiling at $91.75.

Netflix stock daily chart with key support and resistance levels on January 21, 2026. Created on TradingView

Despite beating expectations for revenue and earnings per share, Netflix gave a less optimistic forecast for Q1 2026. Investors are also concerned about the pause in share buybacks and the high costs of the Warner Bros. Discovery acquisition.

Maybe. Strong earnings are helping, but the uncertainties around the Warner Bros. deal, including debt and regulation, remain.

Yes, the strong forecast of $51 billion in revenue for 2026 and a 31.5% margin could ease fears about the deal and push the stock higher if the acquisition goes smoothly.