Marks & Spencer share price is holding around 366p on Wednesday, stabilising after taking a hit earlier in the week following news of a significant cyber attack. The breach, which affected IT services across several UK retailers, raised alarm among investors, with M&S confirming disruptions could stretch into July.

The initial reaction was sharp, MKS stock dropped as much as 4% on Monday before finding some footing near the 350p level. Wednesday’s mild bounce reflects traders trying to assess whether the fallout will materially impact operations or if the selloff was overdone.

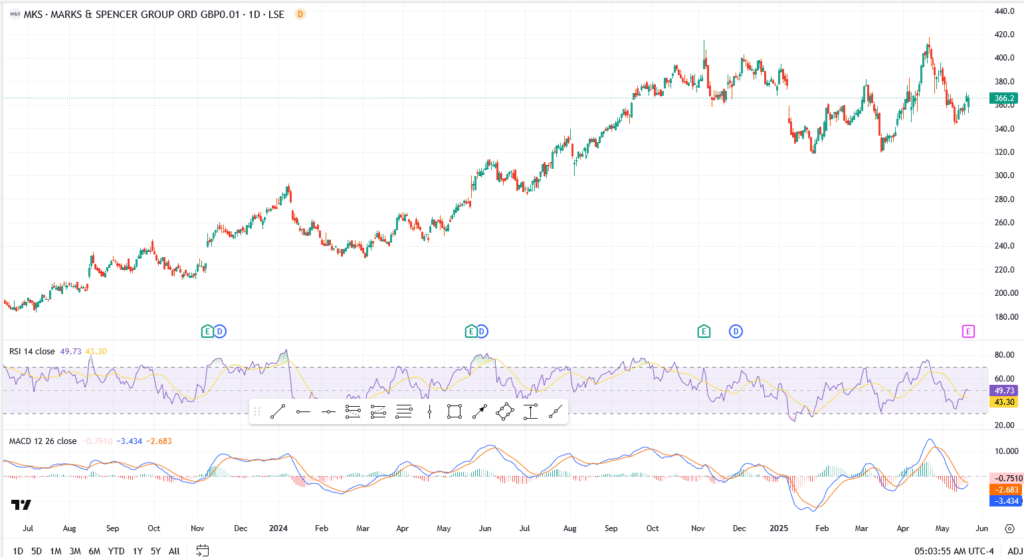

MKS Share Price Chart Analysis

- Price holding around 366.2p after bouncing from Monday’s dip

- Resistance sits near 382p

- Support now stands at 350p

Outlook: Wait-and-See Mood

With the Marks & Spencer cyber attack story still developing, investors are treading carefully. The bounce today is more a pause than a reversal, and the technicals reflect that. If the situation is resolved quickly, shares could retest the 380–400p zone. But if service issues linger through June, a retest of 350p support looks more likely.

For now, MKS stock is trading defensively. Momentum is weak, sentiment is dented, but value buyers are clearly watching.