- Lloyds share price was last at £1 in 2008 and a return to that level underscores the bullish sentiment around the stock

- Flipping the £1 mark into a support largely depends on the current fundamentals improving or remaining unperturbed

- Valuation risks remain after the year-long rally

If you’re invested in UK banking stocks, you’ve probably been watching Lloyds Banking Group (LSE: LLOY) with a mix of excitement and caution. Lloyds share price has just hit the £1 milestone as of this writing, testing a key psychological level that it last saw in 2008. But we’re all asking whether this level will start being a floor that the share price can rely on, or is it just a ceiling waiting to prove that point.

Why the Lloyds Stock Rally Still Has Fuel

Lloyds isn’t running out of steam any time soon, and here’s why. The bank is basically a cash machine at this point. Recent numbers show Lloyds wrapped up a massive £1.7 billion share buyback at the end of 2025. There’s already talk from Jefferies analysts that another buyback could drop when full-year results come out later this month.

Barclays Research points out that Lloyds’ huge portfolio of fixed-rate hedges could actually help the bank this year, even if the Bank of England starts cutting rates. We’re talking about potentially hundreds of millions more on the bottom line. If the price holds, momentum could build. But the real test is execution. Those Q4 results at the end of January will say a lot.

Is £1 Support Sustainable for Lloyds?

Lloyds share price climbed from around 55p in 2025 all the way up to £1, driven by a stronger UK economy, steady dividends, and those giant buybacks. TipRanks says Lloyds confirmed over 58 billion voting shares by year-end, which shows just how massive the bank is. But now that we’ve hit £1, can Lloyds stay there? Honestly, it comes down to what happens in the bigger economic picture.

Lower interest rates from the Bank of England could actually boost short-term margins thanks to Lloyds’ structural hedge that shield against immediate drops. Also, if UK housing picks up, with Nationwide data showing prices edging higher, Lloyds, as the top mortgage lender, stands to gain.

What Are the Risks?

Of course, it’s not all good news and there are certainly some potential downsides to this story. If interest rates do get cut too far, then Lloyds’ net interest margins could be squeezed for the long term. That might just cap profits. And there’s always the issue of valuation fatigue. The stock isn’t exactly the screaming bargain it used to be at 50p, after all – the Price-to-Earnings (P/E) ratio is now sitting at about 14.5.

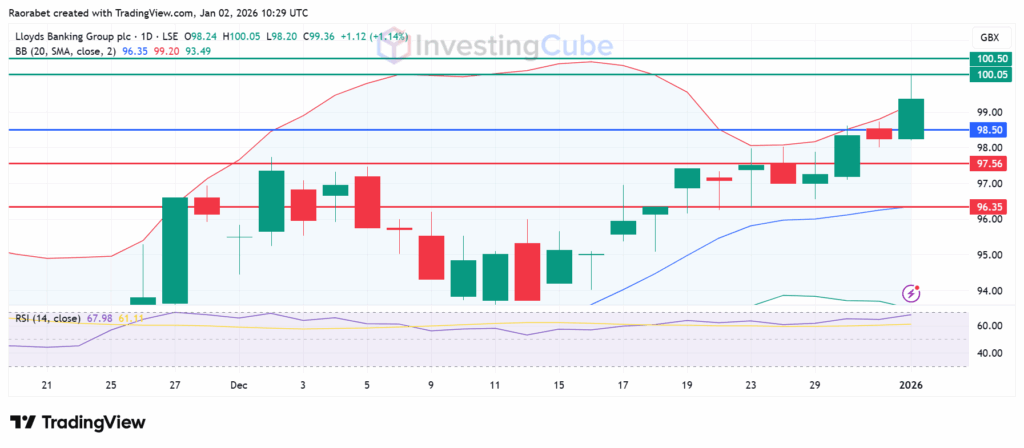

While the long-term outlook is positive, the RSI suggests the stock is approaching a resistance zone. Cautious investors might wait to see if the £1 level is successfully “flipped” into support before committing new capital.

Lloyds Bank Prediction and the Case for 100p Support

Technically, Lloyds is doing pretty well and pivots at 98.50p . It’s trading well near the upper Bollinger Band and the RSI reading at 67.98 denotes a strong upside momentum without being overbought. It’s got a clear the resistance level at 100.05p which is its most recent highs since 2008. If it clears that barrier, LLOY price will likely test 110p.

On the downside, primary support is firmly established at 97.56p and the upside narrative will be invalid below that level. Also, that move could strengthen the downward momentum to potentially test 96.35p, corresponding to the middle Bollinger Band.

Lloyds share price daily chart on January 2, 2026 with key support and resistance levels created on TradingView

The rally, was primarily fueled by UK economic recovery, robust dividends, share buybacks, and rising EPS forecasts.

It could be, if catalysts like interest rates and housing growth hold. However, risks from margin squeezes and provisions might test it. Sustainability will depend on Q4 results and macro stability.

While the long-term outlook is positive, the RSI suggests the stock is approaching a resistance zone. Cautious investors might wait to see if the £1 level is successfully “flipped” into support before committing new capital.