- Lloyds Bank share price gains today have seen it retest its 52-week highs and psychological 80p, signaling onset of potential bullishness.

Lloyds Bank share price breached the 79p barrier on Friday, gaining 1.8% and trading at 79.40 in the mid-morning session. The stock had been trading sideways for much of the last six sessions, and a breakout could usher a stronger upside momentum. The gains are propelled by forecast-beating earnings results released on Thursday, underlined by a 5% jump in H1 2025 pre-tax profit to £3.5 billion.

The lender’s improved performance had help from smaller-than expected impairment damage associated with bad loans. The figure, which rose to £442 million from £101 million in H1 2024, but below the forecast £591 million. Meanwhile, its EPS rose to 3.8p from 3.4p a year ago and the bank raised its interim dividend by 15%, allocating £731 million to shareholders.

Lloyds Bank share price gains today have seen it retest its 52-week highs and psychological 80p mark, signaling the onset of potential bullish takeover. However, on the downside, Lloyds Bank (LON: LLOY) maintained its earlier full-year guidance, which could kill the enthusiasm among some investors and limit LLOY price upside. Also, government tax policy and RBI interest rate decisions could inject strong impetus into the stock’s movement. That said, rising trading volumes point to a strong near-term momentum that could push Lloyds Bank share price higher and establish support at 80p.

Lloyds Bank Share Price Prediction

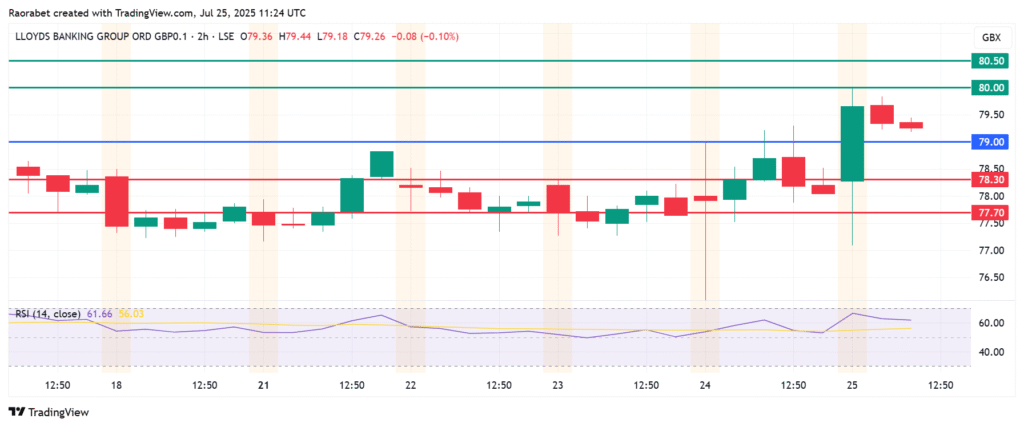

Lloyds Bank share price pivot mark is at 79.00p and the momentum favours the upside to continue. The first resistance will likely be at 80.00p. A stronger momentum will break above that level and potentially test 80.50p.

On the other hand, going below 79.00p will shift the momentum to the downside. That will likely see the first support come at 78.30p. Breaking below that level will invalidate the upside narrative. Also, an extended control by the sellers could push LLOY lower and test the second support at 77.70p.