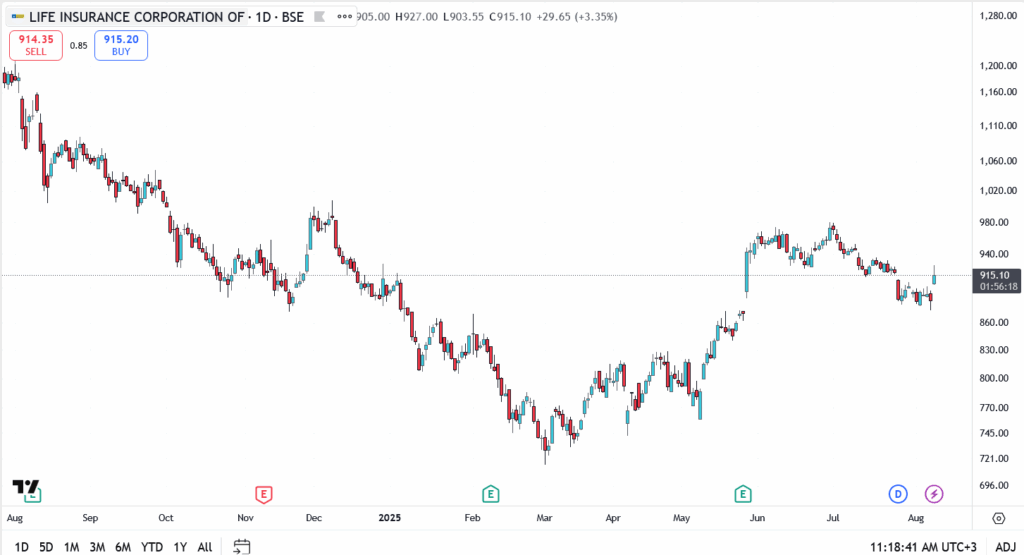

Life Insurance Corporation of India (LIC) extended its winning run on Friday, up 3.35% as of writing. after delivering a solid set of June-quarter numbers. The state-run insurer’s standalone net profit rose 5% year-on-year to ₹10,987 crore, fuelled by stronger policy sales and robust investment income, giving bulls fresh conviction to defend key support levels.

The earnings print eased some of the caution that had crept into the stock over the past month, when LIC slipped from June’s ₹980 peak to sub-₹860 levels in early August. Friday’s bounce signals fresh buying interest, though the broader trend will depend on whether the company can sustain growth momentum in a competitive insurance market.

Analysts See More Upside

Brokerage houses tracking LIC flagged the potential for further gains, with some projecting a rally of up to 10% from current levels. The bullish calls are underpinned by an improved product mix, higher renewal premium income, and stable asset quality in its investment portfolio.

Analysts warn that the stock still faces stiff resistance near ₹940, the level that capped the last rally in mid-July.

LIC Technical Analysis

- Current price: ₹915.10

- Resistance: ₹940, then ₹980

- Support: ₹890, followed by ₹860

Outlook: Watching Follow-Through Buying

Friday’s rally is a positive signal, but traders will be watching next week’s action closely for follow-through buying to confirm a trend reversal. For now, the strong earnings momentum has shifted control back to the bulls. The question is how far they can push before running into heavier resistance.