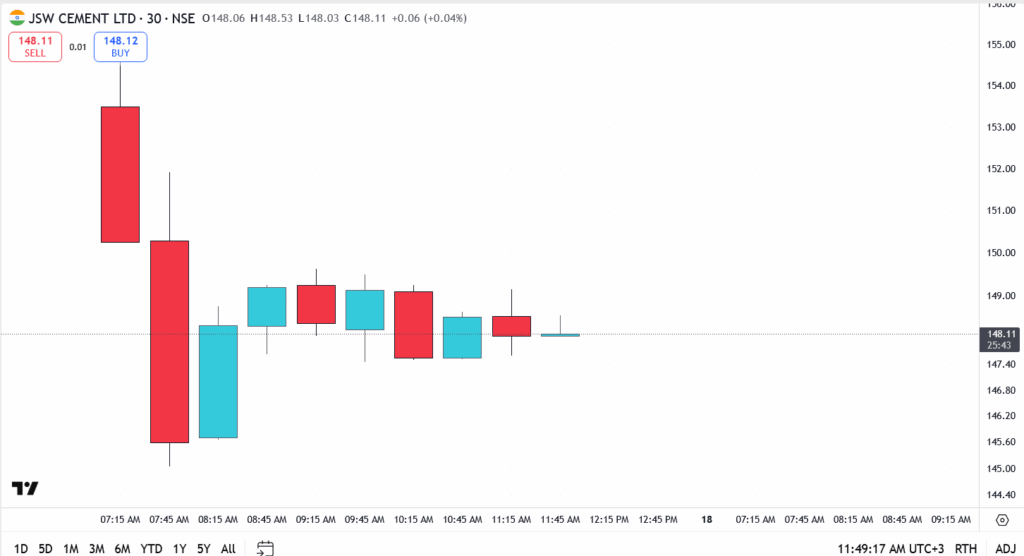

JSW Cement opened to a quiet tape, trading around ₹148 in early sessions as day-one profit-takers met long-only interest. The reception was cautious rather than cold: quick selling hit the first candle, then price flattened as bids built just above ₹147. The read is simple, traders want proof of post-listing follow-through before they chase.

Institutional desks are focused on execution, capacity ramp, and margin discipline through the next couple of quarters. For day traders, it’s a levels market. The first test is whether price can climb back over the round-number zone and hold. Until then, the debut sits in balance, not breakout.

JSW Cement Listing Momentum

Flows looked two-way after the opening shakeout. Early supply likely came from short-term IPO allocations, but volumes cooled quickly, more a tidy book than a rush for the exit. With broader equities mixed, JSW Cement is trading its own story: steady hands buying dips, fast money fading bounces.

JSW Cement Share Price Analysis

- Current price: ₹148.11

- Pivot level: ₹147.50

- Immediate resistance: ₹150.50, then ₹153.00

- Support: ₹145.20, then ₹142.80

Price is hovering just above the pivot after that heavy first bar. A firm push through ₹150.50 would signal buyers are in control and put ₹153.00 in play. Lose ₹147.50 on a closing basis and the market will likely probe ₹145.20; a decisive break there opens ₹142.80. For now, the range is tight and the bias is tactical.

Outlook: Buyers Cautious, Not Absent

This isn’t a blow-off, it’s a feeling-out. Debuts often start with a tidy clean-up of short-term allocations before a real trend shows up. As long as ₹147–145 holds, dip buyers have room to work and momentum traders will keep stalking a move through ₹150.50. A couple of strong closes above that cap would change the conversation quickly. Until then, it’s a patience trade: disciplined entries, tight risk, and eyes on execution updates rather than headlines.