ITC Hotels Ltd (NSE: ITC) surged nearly 5% on Tuesday, with the stock closing at ₹238.90 after a sharp rally triggered by its Q1FY26 earnings beat. The company’s net profit jumped 53% year-on-year to ₹133.71 crore.

Revenue rose 15.5% to ₹816 crore, powered by solid growth in room sales and a strong showing from food and beverage operations. It’s the kind of numbers hospitality bulls have been waiting for, especially with inflation pressures cooling and domestic travel rebounding faster than expected.

Room Rates, Occupancy Fire Up Earnings

The earnings bump didn’t come from luck. Higher room rates, stronger occupancy, and improved operating leverage played their part. After a slow March quarter, the Q1 rebound puts ITC Hotels firmly back in the conversation as a sector outperformer.

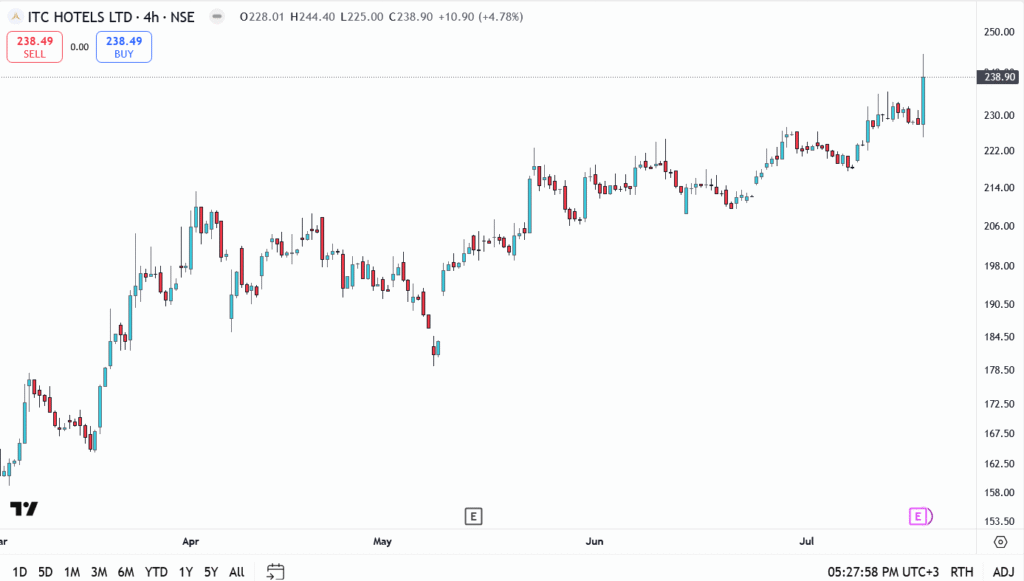

ITC Hotels Share Price Analysis Today

- Current price: ₹238.90

- Intraday high: ₹244.40

- Immediate resistance: ₹244.50, then ₹250

- Support zones: ₹230 and ₹223

Outlook: A Travel-Led Recovery Story

ITC Hotels is benefitting from a broader industry trend: rising travel confidence and robust discretionary spending. If Q2 demand holds steady and margins stay healthy, analysts may start penciling in upgrades for full-year growth.

For now, the technicals are aligned with the fundamentals. ₹250 isn’t just a psychological milestone, it could be the next test for bulls in a stock that’s finally shaking off the post-COVID drag.