Intel Corporation (NASDAQ: INTC) is under pressure once again as the company prepares to lay off factory workers at its Oregon-based Silicon Forest campus next month. The move, expected to begin mid-July, is part of a sweeping cost-cutting program aimed at restructuring Intel’s manufacturing operations. But with the stock still trapped under resistance and buyers hesitant, investors aren’t exactly celebrating.

Intel is trading at $20.14, barely holding the line after a muted stretch of sideways action. Despite broader enthusiasm for AI and chip stocks, Intel’s price action has failed to spark, largely due to weak momentum, cautious sentiment, and a lack of near-term catalysts.

Intel Layoffs Set for July: What We Know

The company has confirmed that it will begin cutting jobs at its Hillsboro factory in Oregon, a key piece of its Silicon Forest operation. Intel has not disclosed the exact number of layoffs, but this isn’t the first wave. It’s the latest in a string of belt-tightening measures, as the firm tries to streamline production costs and shift investment toward its AI foundry ambitions.

A spokesperson said the decision is part of Intel’s “long-term operational strategy,” and the company will support impacted employees with transition assistance. Still, it’s another reminder that the chip war isn’t just about innovation, it’s about survival.

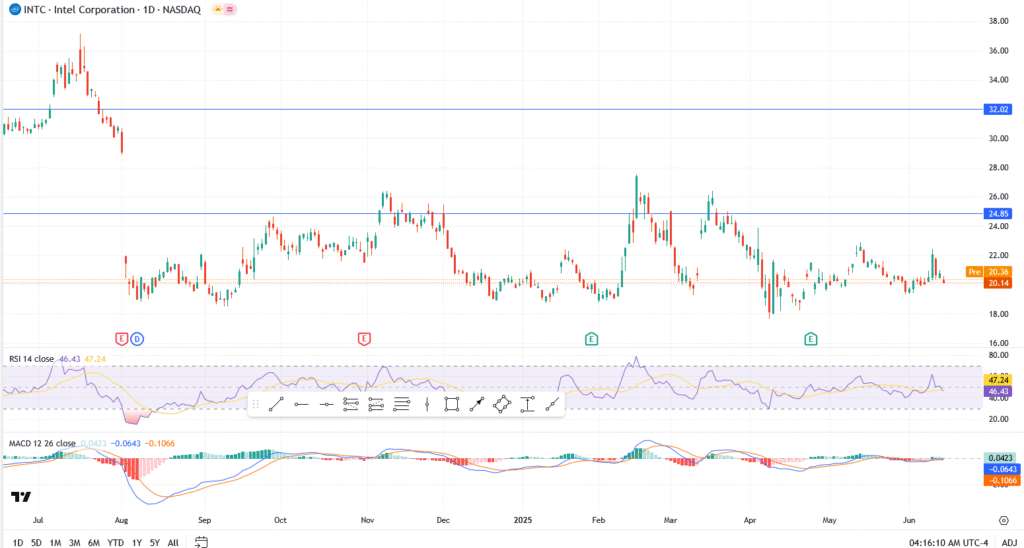

INTC Chart Analysis: $20 Support Still Holding, Barely

- Price: $20.14

- Support zone: $20.00- a make-or-break level that’s been tested multiple times

- Breakdown risk: $18.60 if current support fails

- Resistance: $22.40, then $24.85 (March high)

The RSI sits at 46, offering no strong bias. MACD is dead flat. Bulls haven’t capitulated, but they’ve gone quiet. The longer INTC hangs below $22, the more likely it slides.

Conclusion

Intel’s making the tough calls, and Wall Street is watching with one eyebrow raised. Layoffs might help the bottom line next quarter, but right now, traders are still waiting for proof that this story has turned the page. Until then, INTC looks less like a breakout play and more like a quiet stock with noisy headlines.