- Infosys shares rise nearly 2% as the board approves a ₹18,000 crore buyback at a 19% premium, lifting market sentiment.

Infosys shares gained nearly 2% after the IT services major announced its largest-ever share buyback worth ₹18,000 crore. The Bengaluru-based company will repurchase shares at ₹1,800 each through the tender route, representing a 19% premium over the last closing price.

The buyback will cover approximately 2.41% of Infosys’ outstanding equity and marks the fifth such corporate action in the company’s history. It also surpassed market expectations, which had pencilled in a buyback in the range of ₹10,000–₹14,000 crore. The company confirmed that it has obtained exemptive relief from the U.S. Securities and Exchange Commission to proceed with the plan, which is subject to shareholder approval via postal ballot.

Brokerages Stay Positive on Infosys

Analysts broadly welcomed the announcement, calling it a strong vote of confidence from management at a time of global demand uncertainty.

Morgan Stanley maintained an ‘equalweight’ rating with a target price of ₹1,700, noting that execution could take three to four months based on past timelines. CLSA reiterated an ‘outperform’ rating with a target of ₹1,861, saying the buyback could act as a support during the seasonally weaker second half.

Nomura stayed bullish with a ‘buy’ rating and a target price of ₹1,880, citing the record size of the buyback as a key confidence signal. Nomura projects 3.8% year-on-year dollar revenue growth in FY26, with acquisitions contributing about 40 basis points, and expects an attractive dividend yield of 4.4% on FY27 estimates.

Infosys Chart Analysis Today

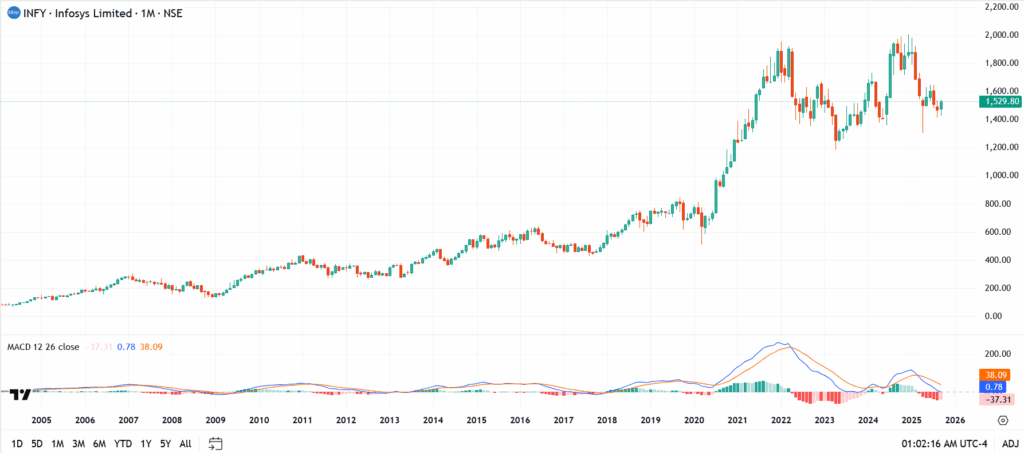

Current price: ₹1,529.80

Support: Initial support sits near ₹1,450, with stronger demand expected around ₹1,300.

Resistance: is at ₹1,600, followed by ₹1,750 if momentum builds.

Trade entry: Short-term traders may eye pullbacks into the ₹1,450-₹1,480 zone as a potential entry, provided support holds. A break below ₹1,450, however, would tilt risk toward ₹1,300.

Infosys Stock Outlook

The ₹18,000 crore buyback signals strong management confidence and should act as a near-term price anchor, especially around the ₹1,800 level. While global IT budgets remain under pressure from macro uncertainty, Infosys’ consistent execution, high-margin digital segments, and push into AI-driven automation give it long-term resilience.

If demand stabilizes, the stock could gradually reclaim the ₹1,750–₹1,800 zone over the coming quarters, but near-term moves may stay range-bound as the buyback execution plays out.