Hindustan Zinc Ltd (NSE: HINDZINC) nosedived by over 9% in early trade on Wednesday, as investors reacted sharply to a ₹3,323 crore block deal executed by promoter Vedanta Ltd. The stock slumped to ₹457.45, erasing most of June’s gains in a single session, and triggering panic across the metals space.

According to multiple exchange filings and block deal data, Vedanta offloaded nearly 5.1% equity stake in Hindustan Zinc through bulk trades, a move largely seen as an attempt to raise quick liquidity amid ongoing debt reduction pressures at the group level.

While the company’s core fundamentals remain steady, the abrupt promoter exit has raised fresh questions about near-term price stability and supply overhang.

Why Did Vedanta Sell Its Stake in Hindustan Zinc?

This isn’t a strategic exit. It’s tactical.

- Vedanta Ltd is raising capital to manage its debt obligations, and Hindustan Zinc remains its most liquid asset

- The ₹3,323 crore block deal came just days after media reports flagged cash constraints at the parent level

- This isn’t the first time Vedanta has trimmed exposure in HZL, but the size and timing spooked the market

For many investors, the sale signals stress, not in Zinc’s operations, but in Vedanta’s balance sheet. And that’s enough to rattle short-term sentiment.

HINDZINC Technical Outlook: Key Levels After the Breakdown

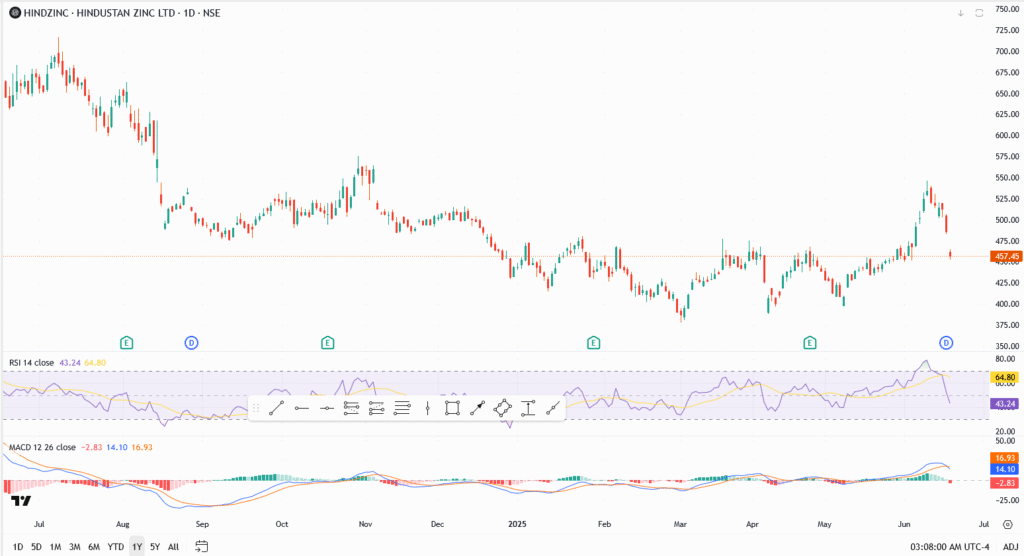

From a chart perspective, the damage is immediate and sharp. The stock has dropped well below its 10-day and 21-day EMAs, with selling pressure intensifying near the ₹475 mark.

- Current price: ₹457.45

- Day’s drop: -9.1%

- Next support levels: ₹445, followed by ₹422

- Resistance to reclaim: ₹483 and ₹505

- RSI: 43 – drifting lower, but not oversold

- MACD: Bearish crossover confirmed, widening divergence

Unless bulls defend ₹445 with strong volume, the pullback could deepen.

Is This a Buying Opportunity or a Red Flag?

That depends on your horizon. From a fundamental standpoint, Hindustan Zinc remains solid. The company continues to report strong operating margins, a steady dividend yield, and has zero operational red flags. But the overhang from Vedanta’s sale could weigh on price action for the next few sessions or weeks, depending on market appetite.

Institutional investors may see this as a value re-entry zone, especially if price action stabilises near ₹445–₹450. However, retail participants should remain cautious until volumes settle and directional clarity returns.

Conclusion

A 9% drop in a blue-chip metal stock like Hindustan Zinc isn’t business as usual. The trigger of a ₹3,323 crore stake sale by Vedanta speaks more to the parent’s balance sheet than Zinc’s future. But in the stock market, headlines matter as much as fundamentals. Until ₹483 is reclaimed, expect volatility to remain high. ₹445 is the zone to defend. For now, Hindustan Zinc’s story isn’t broken, but it’s bruised. Watch how it trades in the next 48 hours. That will set the tone for what comes next.