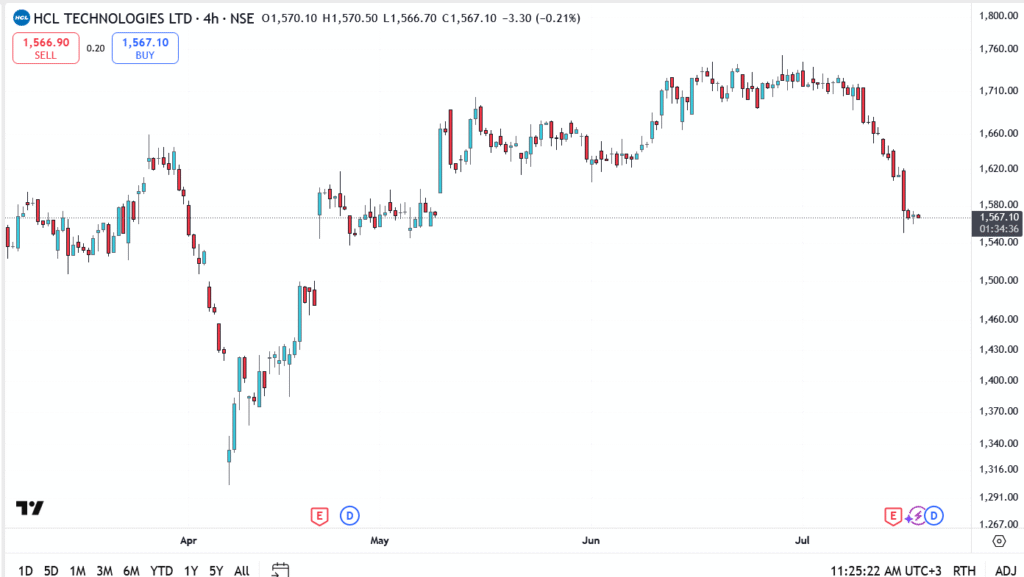

HCL Technologies share price was slightly lower on Wednesday, hovering near ₹1,567 in early trading. The stock has remained under pressure since last week’s Q1 earnings miss, slipping beneath the ₹1,600 level with no strong signs of a bounce. While the initial slide was sparked by the weak quarterly print, price action suggests sellers are still calling the shots.

HCL Tech reported a 9.7% drop in net profit for the June quarter, coming in at ₹3,534 crore, while revenue growth stood at a modest 2.1%. The results didn’t inspire much confidence, particularly in contrast with the stronger performance posted by TCS and Infosys. Investor sentiment took a further hit after the company trimmed its full-year revenue growth forecast to 3–5%, down from the earlier projection of 5–7%.

Adding to the bearish tone, several brokerages cut their ratings in response. CLSA moved from ‘Buy’ to ‘Underperform’, while JPMorgan and Kotak flagged weak product traction and limited near-term growth visibility. That cautious tone is now clearly being priced in.

HCL Technologies Share Price Prediction

HCL Technologies share price is currently pivoting at ₹1,566, with price action below this level signaling further pressure. If sellers maintain their grip, support could emerge around ₹1,540, followed by a deeper downside target at ₹1,480.

On the other hand, a recovery above ₹1,600 is needed to shift momentum back in favor of the bulls. Clearing that level could open the door to ₹1,620, and potentially ₹1,660 if buying accelerates.

For now, short-term sentiment remains cautious. However, the long-term picture isn’t off the table, if HCL can rebuild its growth visibility and steady its margin outlook in H2, a turnaround case may still be on the cards.