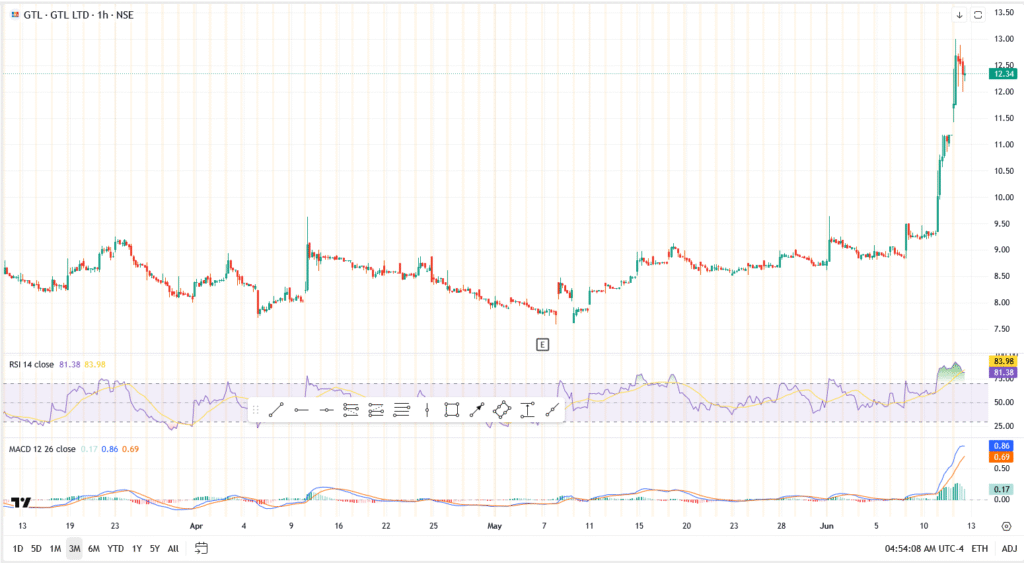

GTL Infrastructure has stolen the spotlight this week, notching a wild 40% gain in just two sessions. As of writing, the stock remains in an upper‑circuit halt on Thursday, leaving the closing quote unresolved. The big question is simple: What should traders expect at Friday’s open?

GTL Infra Chart: Momentum Maxed Out, but Bulls Still in Control

- Price action surged from ₹8.80 to ₹12.34 (based on intraday 1H chart) in a parabolic move

- RSI: 81.38 – overheated but still rising

- MACD: Strong upside momentum, histogram widening

- First red candle appeared after circuit hit, hints at possible cool-off or intraday profit booking

This is a textbook overextension. The bulls have taken the wheel, but technicals are now begging for a pause. Whether Friday opens with another gap-up or a gap-down will depend on volume flows and early sentiment, especially if circuit filters are tested again.

Why GTL Infra Is Moving and Why It Might Stall

There’s no earnings trigger, no new contracts, no insider buying. It’s pure sectoral momentum, telecom infra names are catching fire on 5G buzz and digital expansion themes. GTL Infra, priced under ₹3, is the ideal FOMO bait.

That said, with promoter holdings pledged and financials still weak, the sustainability of this rally is shaky. Short-term punters are driving the bus, not long-term investors.

What to Expect at Market Open Tomorrow

- Watch for a gap-up near ₹13, but prepare for volatility as intraday players book profits

- If the stock holds above ₹12, bulls may try for ₹14 next week

- A break below ₹11.50 could trigger a fast unwind back toward ₹10

Friday’s open could set the tone for next week. If fresh buyers don’t show up early, momentum may fizzle. But for now, the ride isn’t over, just don’t be the last one holding the bag.