- Google Pay and Axis Bank have launched a first-of-its-kind credit card directly integrated with the UPI system, reshaping everyday credit use in India

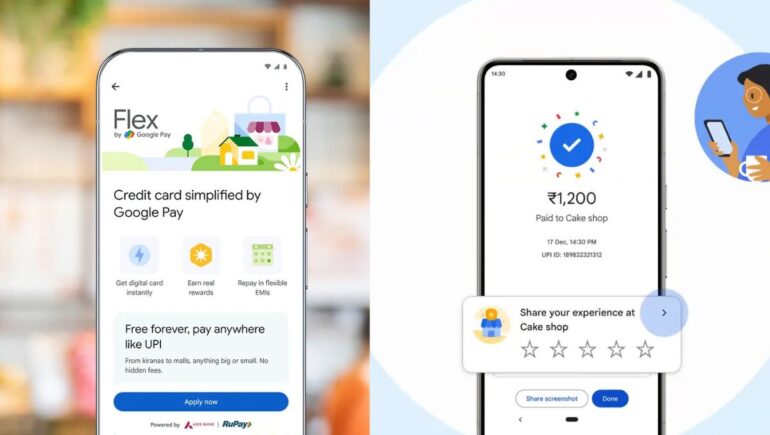

Google Pay has partnered with Axis Bank to launch Flex by Google Pay, a fully digital, UPI-powered credit card designed to make everyday credit more accessible across India. Built on the RuPay network and embedded directly inside the Google Pay app, the Google Pay Flex Axis Bank credit card aims to bridge the gap between UPI convenience and traditional credit cards.

The product targets India’s under-penetrated credit card market, where fewer than 50 million people currently hold a card despite hundreds of millions using UPI daily. To bridge this gap, Google Pay and Axis Bank have launched a first-of-its-kind credit card directly integrated with the UPI system, offering instant rewards, flexible repayment options, and a fully digital experience designed to reshape how everyday credit is used in India’s payments ecosystem.

What Is the Google Pay Flex Axis Bank Credit Card?

The Google Pay Flex Axis Bank credit card is a digital-only RuPay credit card that lives entirely inside the Google Pay app. There is no physical card, no paperwork, and no separate banking app required.

Users apply directly through Google Pay, receive instant approval in many cases, and can start paying immediately using UPI at merchants that already accept RuPay. Transactions feel identical to scanning and paying via UPI, except the payment is made on credit rather than from a bank balance.

This design removes one of the biggest frictions in credit adoption: complexity.

How Flex by Google Pay Works With UPI Payments

Unlike traditional credit cards that rely on POS machines or card details, Flex works through UPI credit rails. That means users can:

- Scan any RuPay-enabled UPI QR code

- Pay at online checkouts that support RuPay

- Use credit seamlessly for small, daily transactions

For users already comfortable with UPI, the learning curve is almost zero. Credit becomes an extension of how people already pay.

Why Google Pay and Axis Bank Are Focusing on Everyday Credit

India’s credit card market has long catered to a narrow segment of urban, higher-income users. Flex takes a different route by targeting everyday transactions rather than lifestyle spending.

The strategy closely resembles how UPI itself scaled: low friction, frequent use, and relevance to daily payments. Instead of asking users to change behaviour, Flex builds credit into habits they already have.

By placing credit inside an app that millions open multiple times a day, Google Pay and Axis Bank are betting that first-time credit users will feel more comfortable adopting Flex than applying for a traditional card through a bank website or branch.

What This Launch Signals for Digital Credit in India

Flex by Google Pay reflects a broader shift in how credit products are being built for India. Rather than forcing users into traditional banking workflows, credit is being layered onto existing payment behaviour.

If adoption picks up, UPI-linked credit cards could sit neatly between buy-now-pay-later products and conventional credit cards, offering structure without friction.

For Google Pay and Axis Bank, the bigger opportunity is not competing with premium cards, but expanding India’s credit user base by meeting people where they already are.

Conclusion

In my view, Flex by Google Pay feels less like a traditional credit card launch and more like a natural extension of how Indians already use UPI. By keeping credit simple, visible, and tightly integrated into daily payments, Google Pay and Axis Bank are lowering the psychological barrier that has kept many users away from cards altogether.

If this model scales, it could quietly change how first-time borrowers enter the credit system. Not through rewards hype or premium branding, but by making credit feel as familiar and controllable as a UPI scan.

You can apply for the Google Pay Flex credit card directly inside the Google Pay app. Eligible users will see an option to join the waitlist or apply digitally, with no paperwork required.

The Google Pay Flex Axis Bank credit card can only be applied for through the Google Pay app. Axis Bank acts as the issuing bank, but applications are not accepted at bank branches or separate websites.

Yes. Flex by Google Pay is fully integrated into the Google Pay app and works seamlessly with UPI payments. Users can scan and pay at supported merchants just like a regular UPI transaction.

Google Pay supports select RuPay credit cards for UPI payments, including the Google Pay Flex Axis Bank credit card. Some Visa and Mastercard credit cards may also be linked for bill payments and limited use, depending on bank support.