- Goldman Sachs stock price is on a hot streak and the bank's growing appetite for bigger earnings in asset and wealth management is paying off.

Goldman Sachs share price experienced a significant upside rally on Tuesday, gaining more than 3.2% and trading at $742 at the time of writing. The performance sent it to all-time highs of $748 in the intraday session and that has seen it gain 5.5% in the last month. In addition, Goldman Sachs stock price is up by 28% year-to-date. The propulsion is attributed to confluence of factors, including a, impressive recent earnings, strategic realignment of business and a favorable outlook for its primary business divisions.

Notably, Goldman Sachs’ realignment away from consumer banking to focus on Global Banking & Markets and Asset & Wealth Management divisions has proven a hit among investors, amid favourable analyst outlooks. The bank reported an 8% jump in investment banking revenue in H1 2025 and the market sees the realignment as a sign of a steadier growth thanks to a bigger revenue stream from those segments. Furthermore, these segments are generally considered as the bank’s specialty businesses.

Notably, so strong is the sentiment around Goldman Sachs (NYSE: GS) that the market ignored US President Donald Trump’s criticism of its analysis of the impact of trade tariffs. Trump’s comments often sway markets and he didn’t hold back against the bank and its CEO, David Solomon, going as far as mocking him and stating that he should focus on being a DJ. Nonetheless, Goldman Sachs stock price is holding up and will likely stay on the upside trajectory in the near-term.

Goldman Sachs Stock Price Prediction

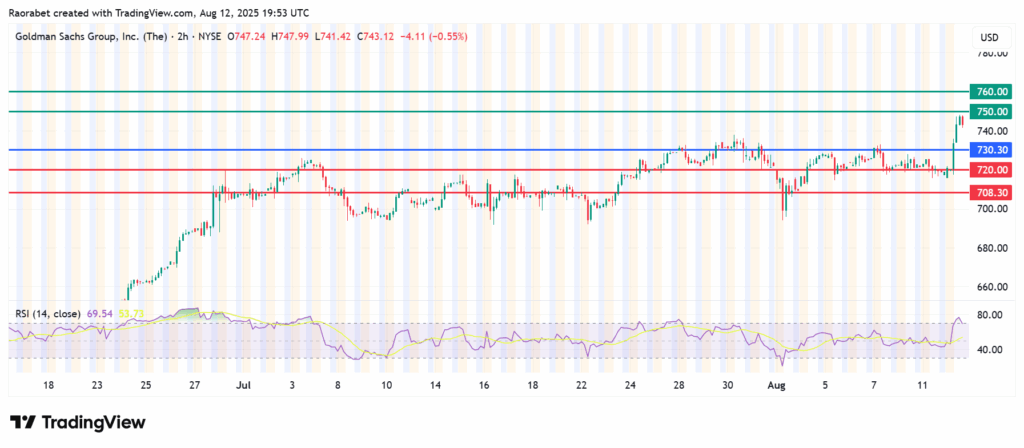

The momentum on Goldman Sachs stock price calls for further upside above $730.30. It will likely meet initial resistance at $750. However, further control by the buyers will l clear that barrier and potentially test the second resistance at $ 760in extension.

On the other hand, going below $730.30 will favour the sellers to take control, with initial support likely to be at $720. The upside narrative will be invalid if the price breaks below that level, and the resulting momentum could clear the path to test $708.30.