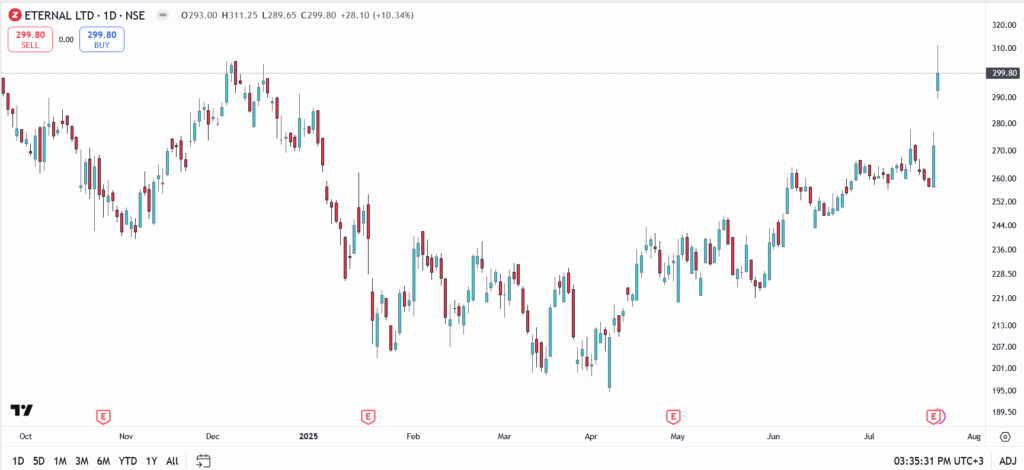

Eternal Ltd (NSE: ETERNAL) extended its winning streak on Tuesday, jumping another 10.34% to close at ₹299.80. The two-day surge has now pushed the stock up 16% since Monday, fuelled by renewed investor enthusiasm around Blinkit’s breakout performance in the company’s latest earnings.

While yesterday’s move was driven by news that Blinkit has officially overtaken Zomato in net order value, today’s rally appears more technical, and possibly, a valuation re-rating in real time. The stock cleared the psychological ₹300 mark in early trade and briefly touched ₹311.25, its highest level in nearly a year.

Is the Market Repricing Blinkit’s Long-Term Value?

Blinkit’s contribution to Eternal’s B2C revenue is now nearly 50% of its total consumer business, according to CFO Akshant Goyal. On an annualized basis, the company is tracking close to $10 billion in NOV (Net Order Value), a figure that puts Blinkit in direct competition with some of the biggest players in India’s quick commerce ecosystem.

Investors may now be assigning more weight to Blinkit’s future cash flow potential, pricing in:

- The possibility of a future spin-off or IPO

- Market share gains in quick commerce vs Swiggy Instamart and Zepto

- Higher operating leverage as unit economics improve

With Zomato already well-established, Blinkit’s growth may be shifting Eternal’s story from food delivery to high-frequency essentials, a faster, stickier business model in the long run.

Eternal Share Price Technical Outlook

- Current price: ₹299.80

- Day high: ₹311.25

- Resistance zones: ₹311.25, ₹320.00

- Support zones: ₹289.65, ₹277.00

Conclusion

Eternal’s two-day rally has caught the market’s attention, and rightly so. The surge in Blinkit’s net order value isn’t just an earnings highlight anymore; it’s becoming a central driver of sentiment and price action.

Whether the momentum holds will now depend on how investors view Blinkit’s scalability, profitability timeline, and Eternal’s ability to retain leadership in India’s quick commerce race. But after this week’s move, one thing is clear: the market is no longer valuing Eternal the same way it did just a week ago.