Coforge (NSE: COFORGE) plunged 9.4% on Thursday, trading at ₹1,676.00 by mid-afternoon, even after reporting a 13.8% year-on-year jump in Q1 net profit and a hefty 50% rise in revenue. The selloff caught many investors off guard, especially with strong headlines pointing to robust deal wins and positive commentary from management. So, what went wrong?

Why Did Coforge Shares Fall Today?

Coforge shares nosedived today because, despite the flashy 50% revenue growth and a solid profit jump, the market wasn’t impressed by the finer details. Operating margins came in softer than expected, and there was no strong guidance to back up the next leg of growth. Add in the fact that the stock had already rallied hard into earnings, and you had a classic case of high expectations meeting a lukewarm delivery. Traders took profits fast, sending the stock sharply lower.

Coforge Q1 Earnings Snapshot

- Net profit: ₹236.2 crore (up 13.8% YoY)

- Revenue: ₹2,358.5 crore (up 50% YoY)

- Operating margin: 15%, down from 16.2% last quarter

- Order intake: $531 million, up from $531 million in Q4 FY24

- CEO commentary: Sudhir Singh said the company’s AI business will be treated as “critical infrastructure”

Despite solid numbers, the muted margin profile and lack of fresh forward-looking surprises led to a broad reevaluation by traders and analysts alike.

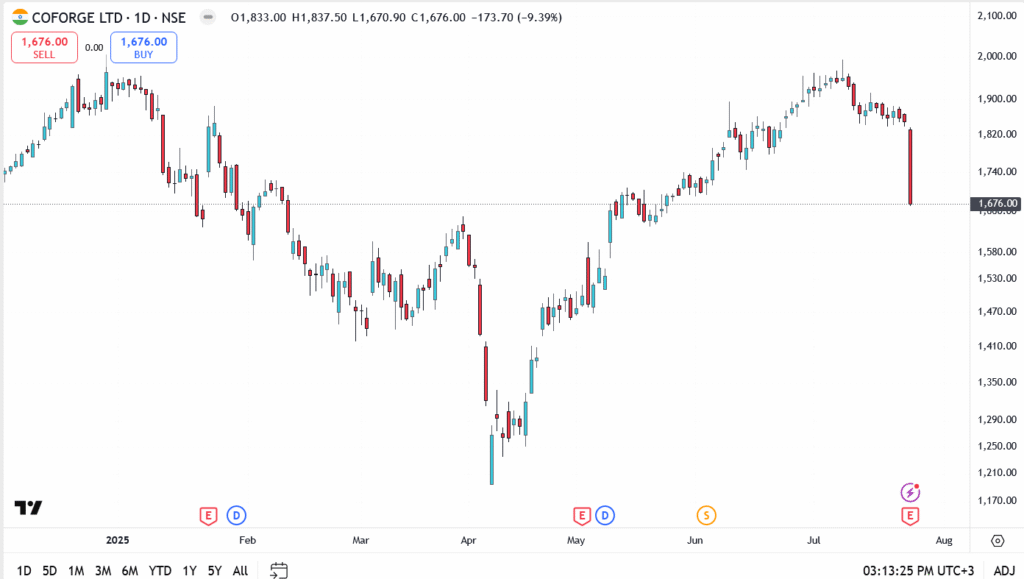

Coforge Share Price Technical Analysis

- Current price: ₹1,676.00

- Day’s low: ₹1,670.90

- Resistance levels: ₹1,720, then ₹1,765

- Support zones: ₹1,620, followed by ₹1,550

- Price sliced below the ₹1,765 support with a wide bearish candle

- Bears in full control after post-earnings selloff

- Next key demand zone sits at ₹1,620 – holding this level will be crucial for any near-term bounce

- If selling intensifies, ₹1,550 may act as the next buffer

Outlook

Coforge has shown strong topline growth and remains a long-term play on AI-driven IT services. But Thursday’s price action reminded investors that valuations and expectations matter. The near-term trend looks fragile unless the stock reclaims ₹1,720 quickly. For now, buyers may want to stay cautious until the dust settles.