Centrica plc (LSE: CNA) is up 4.31% in Tuesday morning trade, last seen at 163.40p, after the company announced a strategic 15% stake in the Sizewell C nuclear project. The move is being interpreted as a long-term bet on energy security and low-carbon baseload power, giving the stock a boost after a muted July performance.

Centrica Buys Into Sizewell C Nuclear Project

Centrica confirmed it had acquired a 15% stake in the Sizewell C nuclear plant, a multibillion-pound infrastructure project backed by the UK government and France’s EDF. The deal marks Centrica’s return to nuclear energy for the first time in over a decade, and signals a growing bet on stable, low-carbon energy sources amid market volatility.

The market welcomed the news, especially as broader sentiment around the UK’s energy sector remains cautious. With energy prices stabilising and government focus shifting toward long-term sustainability, Centrica’s decision to re-enter the nuclear space could help future-proof its portfolio.

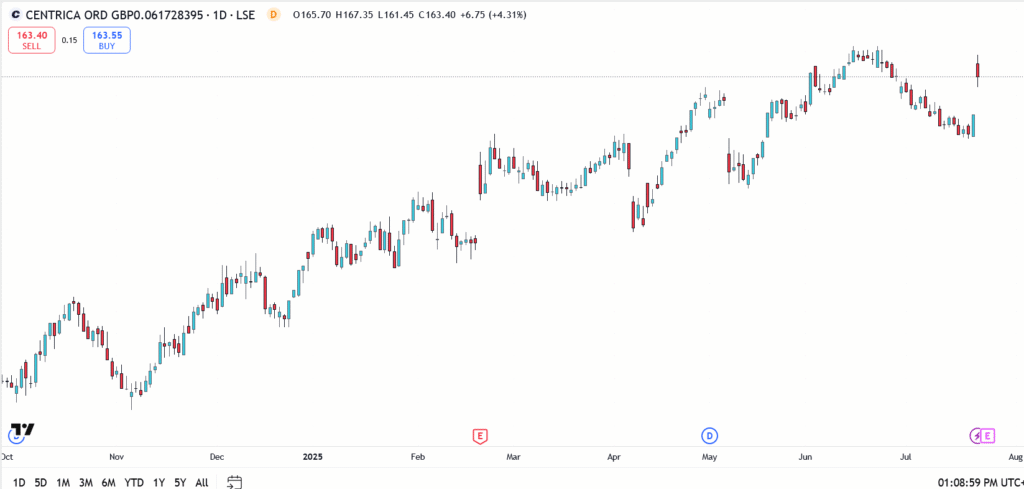

Centrica Share Price Technical Outlook

- Current price: 163.40p

- High of day: 167.35p

- Resistance zones: 167.50p , 172.00p

- Support zones: 161.45p , 155.20p

Outlook: Bullish Repricing or Just a One-Day Pop?

While Centrica’s nuclear investment is fundamentally a long-term move, the market’s reaction suggests that investors see it as a value unlock, especially in a political climate that supports energy independence and net zero ambitions.

The rally may continue if buyers defend the 161p–163p zone this week. However, profit-taking near 167p can’t be ruled out unless further news flow confirms execution strength or regulatory progress around Sizewell C.

For now, Centrica’s re-entry into nuclear appears to be more than just headline grabbing, it’s a shift in strategic direction that’s catching the market’s attention.