- Bajaj Housing Finance holds above ₹120 as traders eye a breakout. Can bulls reclaim ₹125 and flip the trend amid NBFC sector volatility?

Bajaj Housing Finance is quietly making a move. After bouncing off support around ₹111 in April, the stock has pushed back above ₹120 and is now inching toward a critical inflexion point. With broader financial stocks struggling to find direction, Bajaj’s price action stands out, not for a massive rally, but for how well it’s holding its ground.

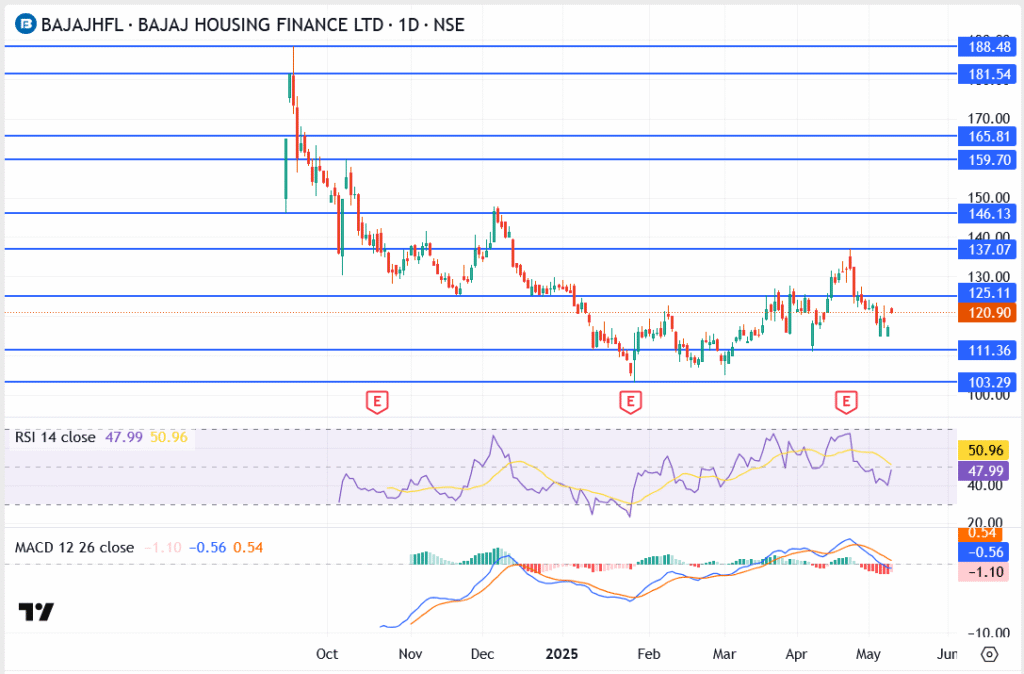

Bajaj Housing Finance Share Price Chart Analysis

Current Price Action

Bajaj Housing Finance is trading just below ₹121, holding steady after a recent rebound from the ₹111 zone. While the price hasn’t broken out, the sideways movement suggests accumulation as markets digest recent volatility.

Support Levels

- ₹111.36: Key demand zone that cushioned March–April declines

- ₹103.29: Major historical support; buyers previously defended this area aggressively

- ₹98.00: Psychological floor, would signal broader weakness if breached

Resistance Levels

- ₹125.11: Immediate resistance; multiple rejections seen here in April

- ₹137.07: Mid-range target if momentum builds

- ₹146.13: Breakout level from February highs, critical to flip bullish

- ₹159.70 – ₹165.81: Long-term upside targets if trend reversal confirms

What’s Fueling Bajaj Housing Finance’s Momentum Today?

The buzz around Bajaj isn’t about headlines, it’s about positioning. The stock climbed over 3% last week even as others in the sector struggled. That caught some eyes.

There’s also the macro backdrop. If borrowing costs ease later this year and housing demand doesn’t fall off, Bajaj could be one of the better-placed NBFCS to benefit. It’s not the flashiest chart, but it has stability. In a choppy market, that counts.

What’s more, price is compressing. That tight range between ₹115 and ₹125? It’s primed for resolution. Directional moves tend to follow, especially after earnings season clears out.

Conclusion

This isn’t a breakout yet, but the setup is there. If buyers can force a close above ₹125, it might be enough to kick off a rally toward ₹137. But if the price stalls again, expect a retest of ₹115 maybe even ₹111.

Either way, it won’t sit still much longer. Traders are watching for a signal, and volume will confirm the move when it comes.