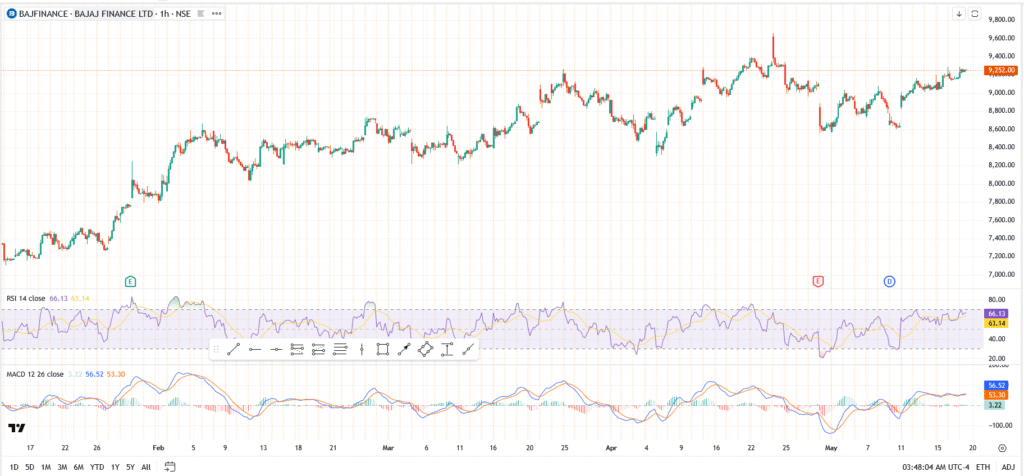

Bajaj Finance (NSE: BAJFINANCE) is edging higher on Monday, trading near ₹9,252 in the early session as the stock builds momentum toward the ₹9,300–₹9,400 resistance zone.

BAJFINANCE has risen 4% from its May lows, and the price is pushing against a resistance area that has held since mid-April. If this level is broken, it could open room toward the ₹9,500 mark in the coming days.

Bajaj Auto’s €125M Infusion Into Dutch Arm Signals Group-Wide Expansion

One of the catalysts contributing to the group’s rising sentiment is Bajaj Auto’s recent announcement of a €125 million capital infusion into its Dutch subsidiary, BAIH BV.

Although this advancement has a direct effect on Bajaj Auto, its consequences are more extensive, indicating a restored global confidence and an eagerness to invest in long-term infrastructure. This strengthens Bajaj Finance’s overall ecosystem, thereby indirectly bolstering investor confidence universally.

Bajaj Healthcare Stock Jumps 7% Sector Buzz Boosts Sentiment

Bajaj Healthcare surged over 7% in Friday’s session, outperforming the broader market. Although it’s a separate vertical, the rally adds to the narrative that Bajaj Group stocks are back in focus.

The positive buzz around Bajaj Healthcare isn’t just staying in the pharma space. That strength is spilling over into other parts of the Bajaj Group, especially financials. Investors seem to be gravitating toward names with solid fundamentals and diversified exposure, and Bajaj Finance, being the group’s flagship NBFC, is clearly one of them.

Bajaj Holdings Sees Fresh Buying as FIIs Circle Back to Financials

Bajaj Holdings has also been quietly gaining ground. It climbed over 2% last week, just as foreign institutional investors started showing fresh interest in India’s financial stocks. With quarterly earnings now behind us and macro volatility cooling, FIIs are rotating capital back into NBFCs, and Bajaj Finance tends to be among their top picks when that happens.

Part of this shift is tied to what’s happening in the background. Bond yields have dipped a bit, the rupee isn’t under pressure like before, and there’s a general sense that the dust is settling. All that makes financials more attractive again — and for Bajaj Finance, it’s creating just the right conditions for a potential breakout.

BAJFINANCE Technical Analysis: ₹9,400 Still the Level to Beat

- Price is hovering near ₹9,252 after a steady grind upward

- Immediate resistance is at ₹9,300–₹9,400 — that’s where momentum has stalled before

- RSI is firm at 66.13 — strong, but not overheated

- MACD still shows a bullish crossover, though the momentum is flattening slightly

If Bajaj Finance clears ₹9,400, that could open the door to ₹9,500 and beyond. But for now, it’s about holding above ₹9,200 and seeing if this week’s sentiment carries through.

- Current price: ₹9,252

- Immediate resistance: ₹9,300 – ₹9,400

- Support zone: ₹9,000, followed by ₹8,640

If Bajaj Finance closes above ₹9,300 today, it would mark the stock’s highest close since March, validating the current uptrend. Watch the ₹9,400 level closely — it’s a zone where sellers have emerged in the past. A break above it could invite follow-through buying toward ₹9,500 and beyond.

Final Take

Bajaj Finance is quietly gaining steam, backed by strong signals from across the Bajaj Group. With fresh capital injections, global expansion plans, and FII inflows flowing back into financials, the environment is supportive. If today’s price action holds, Bajaj Finance could be setting up for a fresh breakout, making it one of the key stocks to watch this week.