Bajaj Finance is pressing up against a familiar ceiling. After a steady climb through April and May, the stock is now hovering just below ₹9,300, with bulls showing no signs of backing off. It’s a slow grind, but one that could flip explosive if momentum holds and volume kicks in.

The question isn’t whether investors like the stock. It’s whether they’re ready to chase it higher, with ₹10,000 now in sight.

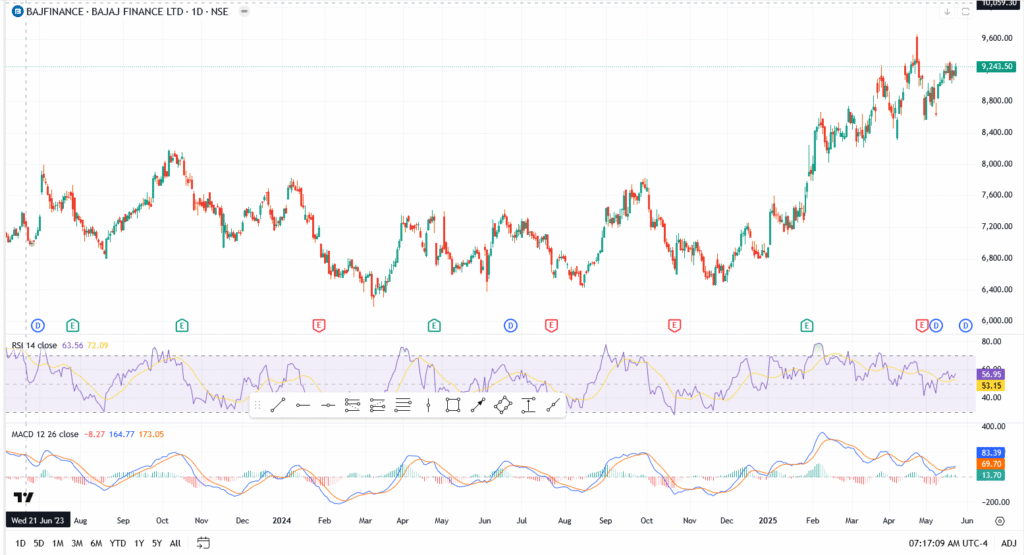

Chart Watch: Bulls Have Control, But They’re Running Out of Room

The technical setup looks healthy, but not without risk.

- Price is holding strong near ₹9,243, just shy of a short-term resistance band around ₹9,280–₹9,300

- Support sits near ₹8,850, which has absorbed multiple dips this month — solid floor for now

- MACD remains in bullish territory, with signal lines diverging again after a brief pause

- RSI clocks in at 63.56, suggesting momentum is alive, but getting warm — anything above 70 would raise flags

- Volume is thinning, which often happens before either a breakout or a rug pull

The structure still favors bulls. Higher highs, higher lows, and zero breakdowns. But the next leg up will need fuel, whether from macro tailwinds, sector flows, or a strong Nifty week.

Traders Split: Take Profits or Let It Run?

Position traders who rode the rally from ₹7,200 have started trimming. But most aren’t out — just cautious. If Bajaj Finance clears ₹9,300 with conviction, the next real resistance doesn’t show up until ₹9,650, the April top. That’s where fresh momentum will be tested.

Short-term pullbacks remain shallow. Until the ₹8,850 level gives way, dip-buyers have a green light.

Bajaj Auto-Steers the Spotlight With KTM Takeover

While Bajaj Finance stays locked in technical limbo, the Bajaj Group is making global noise elsewhere. Bajaj Auto has reportedly taken full control of KTM, the European motorcycle maker it once helped rescue. It’s a high-stakes power move one that reshapes the group’s global two-wheeler playbook and turns Bajaj into a heavyweight in the premium bike segment.

For equity traders, it’s an added reason to keep Bajaj on the radar. While Bajaj Finance doesn’t directly benefit from the KTM move, sentiment often spills over. And if the group narrative stays strong, even financials can ride the tailwind.