- The Scottish Mortgage share price has seen a third day of losses as its 5th and 6th largest shareholders suffer losing performances.

The Scottish Mortgage share price dipped further on Thursday, losing 2.04% to extend its losing run to three days. The UK-based exchange-traded fund has seen its share price dip as Meituan, one of its largest shareholders, fell 10% in Hong Kong trading following reports that Tencent was seeking to sell off its $24 billion stake in the company.

Both Tencent and Meituan are shareholders in the Scottish Mortgage Investment Trust and hold the positions of the 5th and 6th largest stakeholders in the Scottish Mortgage. Tencent’s shares dipped 2% initially but rallied slightly to end the day 0.6% lower.

The continued onslaught by Chinese regulators on Tencent is pressuring the company to make the sale. The Scottish Mortgage share price slump was triggered last week as shares in the companies that constitute its top 4 stakeholders saw red. Gene sequencing company Illumina holds a large stake in the Trust and saw its shares fall 17% on Friday after posting a quarterly loss that has forced a guidance cut. Other stocks that hold the largest stake in Scottish Mortgage, such as Tesla (number 2), Moderna (number 1) and ASML (number 3), also took hits and are all down in various degrees year-to-date.

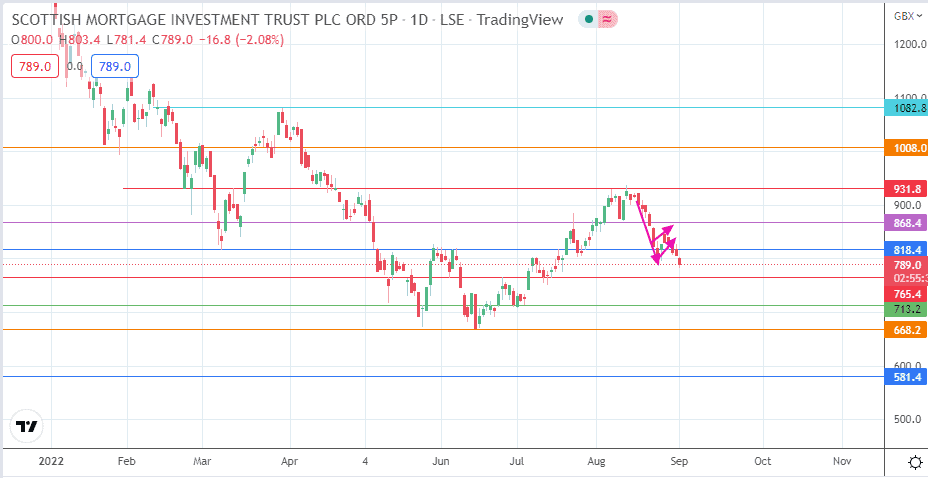

From the technical analysis standpoint, the corrective decline is in tandem with the formation of the bearish flag, whose completion is expected to come at the 713.2 support level. This outlook leaves room for a further decline before the bulls push for a resumption of the recovery and, eventually, the uptrend.

Scottish Mortgage Share Price Forecast

The breakdown of the 818.4 support level via the 30 August closing penetration below this pivot has cleared the pathway for the bears to aim for the 765.4 pivot (7 June and 14 July lows). A continuation of the correction aims for 713.2 (5 July low) before the 16 June low at 668.2 becomes the next target to the south if there is further price deterioration.

The uptrend is restored if the price action breaks the 931.8 resistance (11 March and 5 August highs). However, this is only possible if the bulls seize the momentum and take out the resistance barriers at 818.4 (5-9 June and 15 July highs) and 868.4 (5 May low and 2 August high). In this situation, the 1008.0 price mark becomes a viable target to the north and the intervening barrier to attaining the 1082.8 price mark (30 March 2022 high).

Scottish Mortgage: Daily Chart