- The Royal Mail share price has crawled back even after a series of unfortunate events. What next for the RMG stock price?

The Royal Mail share price has crawled back even after a series of unfortunate events. The RMG stock is trading at 328p, about 13.50% above the lowest level in May. However, the shares are about 42% below the highest point in 2021, bringing its total market cap to about 3.4 billion pounds.

Royal Mail business has been evolving as demand for the company’s services has eased, and the cost of doing business has risen. In its earnings report last week, the 500-year-old company said that the number of parcels it processes has dropped now that lockdowns have ended. Parcel volumes for the last fiscal year rose by about 31%, helped by Covid test kits.

It now expects its business growth to be slow this year. In a statement, the company’s Chairman, Keith Wiliams, said that the company was at crossroads and that it needed to adapt to a post-pandemic world. Some of these measures include hiking stamp prices in a bid to improve margins and the introduction of Sunday postal services. It also intends to change its shift patterns and increase its automation.

Royal Mail is also suffering from the ongoing jump in the cost of doing business. Wage inflation has risen while the company has seen a sharp increase in energy and fuel costs. Another challenge is that the company has struggled with its union as the Communication Workers Union has sought a 1% pay hike. All this make it difficult to recommend Royal Mail as it gets booted from the FTSE 100 index.

Royal Mail share price forecast

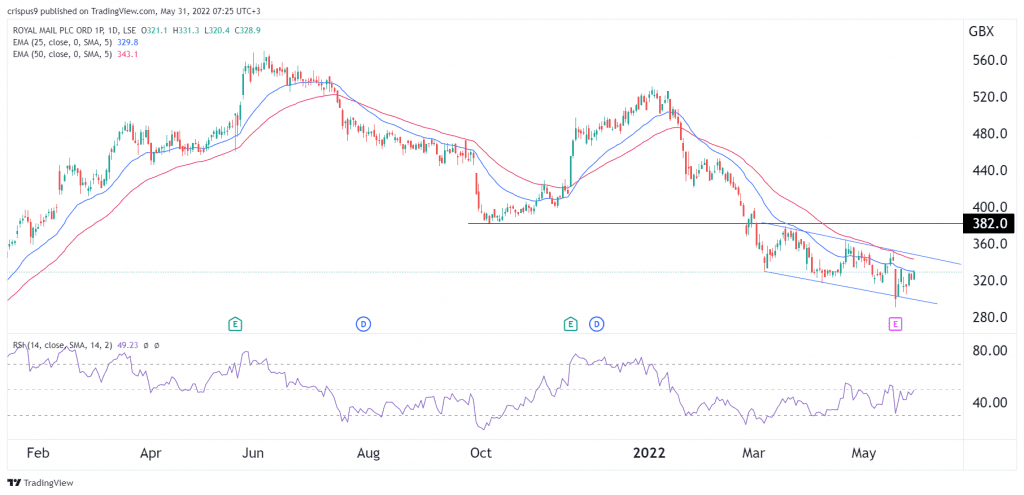

The four-hour chart shows that the Royal Mail share price has been in a strong bearish trend in the past few months. The stock has formed a descending channel shown in blue. At the same time, the shares have moved below the important resistance level at 382p. It also moved below the 25-day and 50-day moving averages, while the Relative Strength Index has moved to the neutral level at 50.

Therefore, the RMG share price will likely continue falling as bears target the key support at 290p, which is about 12% below the current level. On the flip side, a move above the resistance at 340p will invalidate the bearish view.